Vinay Gupta has layers within layers. Though his lineage is partly South Asian, his lilting burr has the unmistakable mark of a Scottish upbringing. His education was in engineering, but he has spent much of his career helping governments and militaries strategize around energy and disaster preparedness. While working in the defense sector, he was also making regular appearances at early Burning Man events. Those disparate pursuits converged in his design for the Hexayurt, a sturdy, portable, inexpensive shelter intended for use by climate refugees, now omnipresent in Black Rock Desert every year.

Gupta’s latest chapter has him deeply involved in the Ethereum ecosystem and blockchain economics more broadly. He project-managed the launch of the Ethereum platform, and now heads Mattereum, a “smart property register” that aims to do for high-value business assets what eBay and Amazon have done for retail e-commerce. More than just technology, Mattereum aims to address the legal and commercial challenges to putting property on the blockchain.

The resulting transparency, accountability, and access, Gupta argues, will unlock trillions of dollars in value around the world. He recently spoke with BREAKER about the the potentially immense benefits for the developing world, the environment, and the future of humanity.

It seems like your driving interest is in sustainability and resilience. Was the Hexayurt your first entrance into this space?

Yes, the Hexayurt was where I got started in all this. Prior to that point, I’d largely been interested in software, virtual reality, this kind of stuff. Then after 9/11, I began to get much more interested in the world as a complex system. I [joined] Rocky Mountain Institute, arguably the top energy policy think tank in the world. From there I went through a series of military think tanks, and eventually wound up coming back into industry, when I joined the Ethereum team as a project manager in 2014.

One major concern after 9/11 was that we were dependent on Middle Eastern oil.

Yes, exactly that kind of thinking. Why are we in this mess? What’s really happening?

What was the analysis that you arrived at, about either 9/11 or the broader context?

I helped produce a book called Winning the Oil Endgame, which was written by RMI analysts, and argued that oil would be obsolete long before you could have any geostrategic resolution on access to oil. If you put your energy behind technological innovation, in all probability, the oil would be obsolete before you had actually secured a supply.

That hasn’t necessarily played out in the way you might have expected, since the big swing in oil has been from fracking, not necessarily from renewables and other technologies.

Absolutely. This is the tragedy—we wound up with a solution, but it’s a nastier, dirtier solution than what we had already. It’s better geostrategically, but certainly worse environmentally. These are the trade-offs of the real world: Sometimes you wind up doing stupid things that still work.

You started off in computing, as an engineer, and then shifted to bigger problems. Do you think you brought a unique mindset to geostrategic work?

Sure. In the defense world, there’s basically no method by which defense contractors or other engineers cross the fence and wind up actually helping make command decisions. So I wound up, in both the policy world and the think tank world, with a completely different perspective: That these are engineering problems. If you don’t like what’s happening in your oil supply chain, you can get rid of your oil supply chain. You can just solve the problem at a technology level, and the policy stuff becomes completely irrelevant.

Have you found people receptive to that? Because one of the big things happening in politics, in the U.S., at least, is declining respect for practical, science-based answers.

I think we did reasonably well, but if all that stuff had been going great, I probably would have stayed in that game. I came back into [the tech] industry because I think we hit some limits on the willingness of the field to absorb those kind of ideas.

What was the genesis story of the Hexayurt?

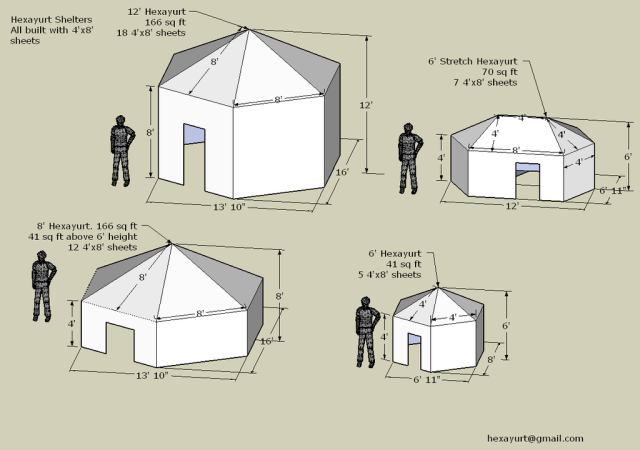

In 1995, I was asked to take a crack at redesigning Buckminster Fuller’s geodesic domes, specifically to make them easier to make out of four-by-eight sheets—that’s the size industrial materials like plywood come in.

I spent about six months on that project and didn’t really make much progress. Then I came back to it in 2002 and cracked it in about 15 minutes.

Is the goal primarily to provide better and less wasteful housing for refugees and disaster victims?

No, that’s a stepping stone. The problem that we have globally is that we’re at roughly four planets’ worth of consumption as a species—we’re massively overconsuming. The first approach to solving that is to use less resources, moving to solar energy and electric cars, for instance. But Americans are at roughly ten planets’ worth of consumption right now, so you’re talking about reducing that by 80 percent or 90 percent to get them to sustainability.

The other approach is to start at the bottom of the pyramid. If you’ve got folks who are currently at half a planet’s worth of consumption, the people who are very, very poor, you could do an enormous amount of work to raise their standards of living without increasing their resource use.

For example?

One great example is solar lights in Africa. People were spending on the order of $100 a year for kerosene [for lighting]. It was terrible in terms of health because of indoor air pollution, it was marginally contributing towards climate change, and it was a constant drain on the microeconomics of families, because they’re just throwing money down the oil supply chain.

But over the past 10 years we figured out that you could just deploy small solar lights, just selling them in gasoline stations and truck stops and tobacconists. And the payback time [for buyers] is usually weeks rather than years.

Nobody ever thought about that being a humanitarian project. They just thought they could make a buck selling something useful. And it’s a huge economic development, because it’s keeping hard currency in the local economy. It’s just the market generating these tools, and they’re doing an enormous amount of good.

"There’s an enormous prize for getting the electricity consumption out of crypto."

So the Hexayurt is your version of that for housing?

Well, the Hexayurt isn’t just a housing project. They’re cheap, and they’re super insulated, and they’re also mobile, so you can fold it back up and move them. So when populations move, you don’t have to throw away all the capital spent on housing. But there’s also an infrastructure modeling language called Resilience Maps, which allows you to figure out how to design the critical infrastructure in a way that meets the economic, political, and environmental needs of those populations.

So you roll that stuff out first in the refugee camps, and if it works well enough there, you can take it directly into the mainstream market as a kind of IKEA for the developing world. You solve the combined environmental, public health, and economic problems by deploying better technology.

One of the early Hexayurt demonstrations was at Burning Man. Was that just by chance?

My first burn was in 1996, so I was well aware of how much tent camping sucked at Burning Man. So I thought, let’s take the Hexayurt out into the desert and see if it works. And it was very dramatic.

I remember opening the door of the Hexayurt after the first night sleeping in it, and there was a huge dust storm, 60 mile-an-hour winds, one meter visibility. And I didn’t know that was out there until I opened the door. And now they build millions of dollars worth of Hexayurts every year at Burning Man. There must have been five or seven thousand units on the playa this year.

We’ve had a lot of updates recently about the climate scenarios for the next 30 or 40 years, and they’re looking increasingly bad. Do you have a bleak view of the future, even as you’re trying to improve things?

The rosier scenario has never actually existed. The Hexayurt project’s goal was to provide the tools necessary for management of 150 million climate refugees, and I started working on that level in 2002.

And I used to say, about people who are worried about collapse in the U.S. and U.K., that collapse just means living in the same conditions as the people who grow your coffee. The privileged first-world bubble shatters, and you end up being dumped into the real world where everybody else lives.

Yikes. What’s the status of the Hexayurt project now?

Same as it ever was: open source, open hardware, no copyright, no patent, no bank account. And it’s very successful, it’s heavily deployed. I’m going to get back to it in a serious way in five or 10 years, when I can go back with real resources. I’m pretty convinced there’s no way of raising the necessary money other than going out and making it myself. I’ve never seen anything in the charitable sphere that has the ability to fund that kind of long-term R&D.

In 2014 you started working on Ethereum. Why was that of interest to you?

Well, I decided I was going to go back into industry. The think tank thing wasn’t really paying, I was 40, I was sick and tired of working on academic salaries. And it was pretty clear to me that the world’s becoming an increasingly bleak and difficult place. The ecosystem niches I’d been inhabiting were gradually drying out. It was harder to find grant funding.

Related: Real Estate Token Sales Are So Next Year

And right around then I heard the Ethereum team start to talk about smart contracts, and I remembered talking about those waaaay back in the early stages of the crypto revolution. And at the time they were hiring, so I got pulled on board the team and never looked back.

My work for Ethereum was in two phases. In phase one, I spent most of my time doing external communication, and phase two I moved into project-managing the release process. And mostly that was an internal coordination job.

And what is your involvement with Ethereum at this point?

I run a company called Mattereum. We’re building out a set of stuff that we expect to work on the Ethereum ecosystem. I’m on friendly terms, obviously, with my old collaborators from the [Ethereum] Foundation, and I’m not immune to doing a bit more work at the foundation if anything comes up.

You seem well-positioned to comment on issues around proof-of-work and electricity usage and environmental impact. Is that something you’ve paid attention to?

Sure. The proof-of-work thing is a massive hack, there’s no way around it. In computer science, there are a bunch of ways of solving hard problems, but one of them is to do the simplest thing that could possibly work. And proof-of-work is the simplest thing that could possibly work. It’s a completely brute force approach.

Then you sit back and look at it and think, why are we still doing that 10 years later? Surely, we shouldn’t be throwing away millions of dollars a day to electricity providers. So there’s an enormous prize for getting the electricity consumption out of crypto. There’s no doubt at all somebody’s gonna crack it. I think Ethereum is well positioned to make that happen. And we’ll see how it goes.

Where are you in debates about decentralization more generally?

I’ve never really thought decentralization was the point of these things. I was an eGold user; I thought eGold was fantastic. A hundred percent of my income went through eGold in, I want to say, 1999. I was very interested in digital currency. That’s where I got my start in this whole mess.

And then, of course, because it was centralized, it eventually got shut down.

Right, and that leads to the idea that decentralization is what all these currencies are fundamentally about. But they’re not—they’re about stability, accountability, and transparency.

I just had a conversation with an expert in global corporate bribery who made a similar point about transparency.

Yeah, to me, that’s where the action is. Or, with carbon emissions—with the right kind of blockchain payment infrastructure, you could make sure that every gram of carbon that’s emitted is tracked. And you could start sending out bills for it.

Matterium, as I understand it, is primarily a smart-property platform, trying to fractionalize ownership of real-world objects on the blockchain.

Fractionalized ownership is one of the things you can do, but what we’re really about is getting physical property under smart contract control. Right now, the blockchain is a bit useless—you can’t buy a house, you can’t buy a car. It just doesn’t have the kind of all-singing, all-dancing, total economic transformation stuff that’s in theory going to happen. You can sell your bitcoin and buy fiat currency, but that doesn’t end up changing the fundamental economic efficiency of the world.

So what’s that more efficient economic structure that blockchain enables?

Right now, something like 20 percent of all the assets in the world are not being used—spare capacity in factories, empty houses, empty office buildings. There’s maybe, ballpark, $100 trillion worth of assets just sitting around, because we haven’t been able to build market infrastructure to put those assets to work. At the consumer level, you have eBay, which created value out of stuff sitting in people’s garages. At a consumer level, there are maybe a few trillion dollars worth of stuff—but that’s not where the action is.

There is no meaningful business-to-business ecommerce, because credit-card payments just don’t work for real business payments. The payments are too big, and they’re structurally complicated. The B2B market is four times the size of the consumer market, and it’s got no meaningful e-commerce on it. So, clearly, that needs to get fixed.

How does blockchain solve that?

Blockchain gets you a new payment rail that’s entirely internet-based, and it’s got a lot of the attributes you’d want for business payments. So if you’re paying once a month for some kind of service, attach the service contract to a smart contract, and it gets paid every month—very simple, very straightforward.

And that logic can be seen by both partners to the deal, because it’s on-chain. You’re not trying to coordinate two different, incompatible computer systems. The whole architecture is much more what you’d need in a business setting.

I’m not sold, though, on the idea that this will be done in bitcoin or Ether. I think, largely, this will be done in things like stablecoins.

That’s interesting because a lot of the obstacles to consumer cryptocurrency adoption are things like key management, irreversibility of transactions, and the high labor involved in each individual payment. But that complexity is already part of the business-payments environment, so maybe it’s not as much of a barrier.

Precisely.

And is the basic idea behind Mattereum is that businesses are going to provide some kind of public offering of underutilized assets, and other businesses will see those and figure out ways to use them?

In the long run, yes. In the short run, we’re going to do some asset securitization stuff, starting with a Stradivarius violin. We’re taking that violin and we’re packaging it in a governance structure that will ensure that the violin gets played and is an asset that’s kind of public, rather than being locked in a vault.

So regarding the legal structure that you’re using to make this happen, does Mattereum itself have formal ownership of the object?

It’s a little more complicated than that. What we have is a multi-tier custodial arrangement, where the objects are legally owned by a specialized class of custodians, who are also legally obligated to obey the instructions of a blockchain smart contract.

What we did was basically just went down to the very, very basic level of the more or less internationally agreed-on basics of property. And then we just cranked out the necessary legal infrastructure to make sure that we can directly connect those to smart contracts. It turns out that property rights are property rights, whether the software used to manage those property rights is the blockchain or Excel.

Is this just about unlocking underutilized resources, or are there other implications for the broader global economy?

We’re trying to do something more fundamental than that. Right now, the blockchain has no commercial infrastructure, and that’s what you need to get the property under the control of a smart contract: payment rails, identity providers, insurance companies, escrow agents. We still need all of that before the blockchain space explodes. We’re providing one part of that—an automated custodian and smart property register.

Lots of blockchain companies have raised large amounts of money to go off and do the work of making assets liquid, and we expect to be working with a lot of those companies doing all of their legal back end. So if you’re doing something like tokenizing real estate, you may discover that it’s much easier for Mattereum to handle the asset locking and then for you to go do the tokenization.

"What the internet did for information, I think the internet is about to do for property: all the stuff, all the bonds, all the shares, all the real estate, all the commodities, highly visible, highly available."

You mentioned tokenizing real estate, and I think there are some consequences that could be concerning in globalizing ownership of these local properties. Even in the pre-blockchain world, financialization has had some negative impacts for cities in particular. Are there risks that you see for making everything liquid and mobile?

Short answer: Yes. Long answer: What’s the alternative?

There’s no question that this fluidization of property is the general tendency of history. The question is whether it’s going to be expensive and difficult and only available to the rich, or whether it’s going to be cheap and democratic, and at some point those markets will be available to everybody.

In the U.S., for example, practically all of the upside of the dot-com ecosystem was only accessible to accredited investors, and inside of tight-knit Silicon Valley social circles. Otherwise, you were never going to get the opportunity to buy into this stuff. And the same thing applies to other kinds of property. If you’re some kid in Bangladesh, and you could put a dollar a month into New York real estate, you’re probably better served by doing that than storing it in your local currency, or even storing it in cryptocurrency.

So you see more money going into the same development centers—major cities like New York?

No, I think that what you’d get is an equalization of access to information. And you’re going to find that the best deals are not to be had in the places we think.

Where’s the vast majority of economic growth? The developing world. If you’re looking for a 20 percent growth rate, you have to look at very specific places in developing countries. Surely, that’s where you’d want to put your money if you were interested in making a buck. But right now, there’s a lack of transparency [about those places], and a lot of hardship getting the money in and out. If I want to invest in bicycle shops in Bombay, how do I get the money into these businesses? Their growth rates might be phenomenal, I just don’t have any way of getting capital in.

There’s a huge amount of work to be done just making sure that the stuff which is actually economically growing is adequately capitalized. There is no Google, no single mechanism, for figuring out where to put your money. What the internet did for information, I think the internet is about to do for property: all the stuff, all the bonds, all the shares, all the real estate, all the commodities, highly visible, highly available. I think that’s the inevitable thrust of history—the blockchain is just the latest technology to take us forward in that direction.

That said, greater fluidity does come with perhaps greater volatility. Is this going to make regional crashes more violent?

No. These crashes happen because you should never send a human being to do a machine’s job. The traders don’t have enough time to analyze all the investment options in front of them. All of the data is in weird little silos and stupid formats like PDF files. You can’t do an apples to apples comparison, and you can’t get enough information to trade intelligently.

So what’s left is just fashion and stampede. Somebody says hey, subprime mortgages, let’s do more of that! And everybody piles in behind. If all of that stuff had been pulled into software systems, you could actually have taken a look and say, wait a minute, there’s not that much subprime stuff that’s actually there. I don’t know what we’re investing in, but it’s not mortgages.

You mentioned one of the most consistent themes I’ve picked up this year—that what blockchain is truly about is transparency.

Yes. I think financial regulators in the future will probably mandate the use of blockchain, for exactly the reasons you have things like prospectuses necessary to do an IPO. You have to get really high-quality information in the hands of decision makers before they can make a reasonable choice. The same thing goes for the global financial system.

And part of the core Mattereum story is that what we want is really rich data representations of the assets in the system. You take the violin, you take CAT scans of the violin, you absolutely define what the object is, where it came from, who owned it—and all that information goes on-chain. You can do the same thing for the coffee in your cup, for your car, for your laptop.

What we’re talking about is standardizing the information about physical objects such that you can manage the object intelligently with computers. So, rather than having opacity about the histories of the things that you’re touching, you can have real knowledge. In the long run, it becomes a way of understanding the asset and its implications, because the thing is its implications. The object is its implications, its history, and its future.

And we need to do that, because we’re doing a terrible job of organizing the real world right now.

Photo: Sebastiaan ter Burg (Flickr)

This post has been changed to clarify Gupta’s role at the Ethereum Foundation.