According to an overview in the latest issue of the crypto newsletter Diar, the market for initial coin offerings (ICOs) is sharply divided between winners and losers. Investing through these broadly accessible (and questionably legal) sales of digital assets, it seems, works a lot like a day at the racetrack with Ricky Bobby: If you’re not first, you’re last.

The Biggest Losers

Diar, working with stats from TokenData, found that as of this month 402 out of 562 ICO-distributed tokens have lost value since their public crowdsale. Those 402 projects raised more than $8.2 billion, but their tokens are now worth only $2.2 billion, for a collective loss of $6 billion.

For those interested in growing their finance vocabulary, that is what is referred to in technical terms as “a metric shit-ton” of lost money.

Diar also (presumably with a rattling, mirthless chuckle) tallied up the worst-performing ICOs. At the very bottom is Sirin Labs, whose plan to release a blockchain-oriented smartphone was cut off at the pass by HTC’s Exodus. Sirin, which has now shaved a total of $141 million in token value, also further confirms the importance of staying far away from any ICO with a paid celebrity endorsement. Sirin’s was football titan Lionel Messi, for no apparent reason.

A more surpising megaloser has been Bancor, which had a high-profile, reputable-ish $153 million ICO in June of 2017. The token first tanked just months later when critics started questioning its core premise. Then came a major hacking theft in July of this year, with the whole Wile E. Coyote-caliber catastrophe wiping out a total of $80 million in investor value.

Even these tokens, though, aren’t the real bottom of the barrel—Diar found that a staggering 324 ICO tokens, with a total of $2.3 billion raised, aren’t even listed on any exchanges. Because they can’t really be bought or sold, they have no determinable “market value.” It’s kind of like Schrodinger’s Cat, but for shitcoins.

It’s Lonely at the Top, But I Sleep Fine On My Pile of ADA

So, big ICO funding rounds, many led by incompetents and scammers, have led to some huge, swift losses for investors. But prominent ICO-funded projects like Cardano and IOTA have managed to generate solid returns for early buyers even after the winter bubble’s burst—success that Diar attributes mostly to “Ogilvy marketing know-how.” Top ICO performers now also have huge war chests full of their own tokens.

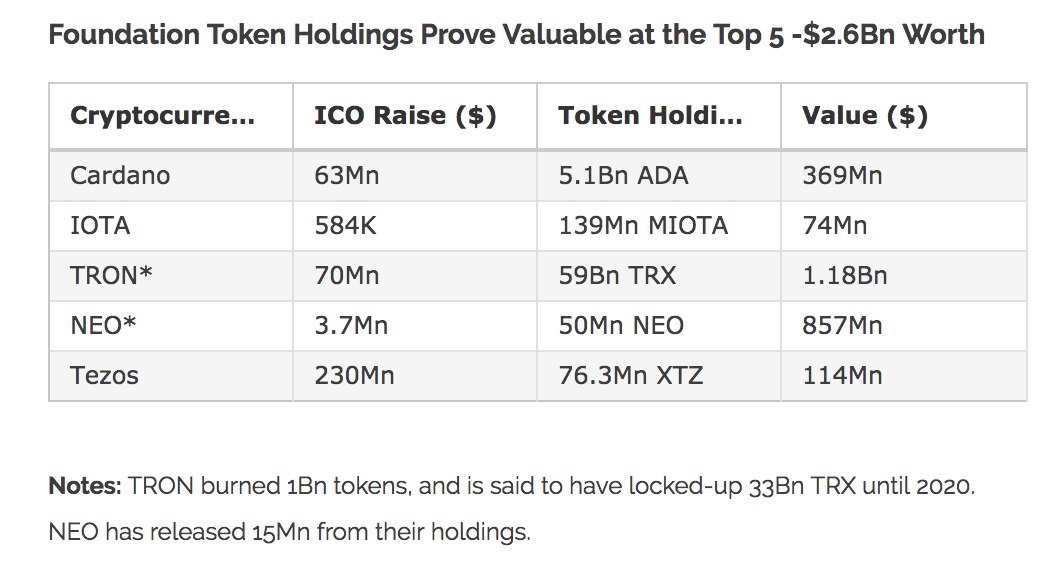

Here are the top five, per Diar, with holdings totaling $2.6 billion:

What’s really notable here is that certain projects’ holdings of their own token (what we old-timers used to call a dreaded “premine”) make up huge portions of the total $USD market cap of their coins. Fadi Abdoualfa, founder of Diar, sums up this oddity: “With tokens representing no equity, and also no utility either, as none of these projects are live, the fact that these companies are sitting on piles of cash is irrelevant to markets. It’s a disconnect of traditional valuations.”

Regardless, the main take-home is clear—the relative success of the top handful of ICO projects is a sharp contrast to the abysmal losses of the larger mass of lower-quality, fraudulent, or just poorly marketed efforts. The way to win in the crypto markets, it seems, is to predict where the crowd is headed, and get there first.