The fork—which Vitalik Buterin suggested should really be called a “network upgrade”—will introduce five new Ethereum Improvement Proposals (EIPs) to the network, and mark a significant milestone in Ethereum’s continuing development.

In advance of the event, we took a moment to review the changes that will be implemented, including the crucial issue of mining rewards and inflation in the overall supply of ETH.

Why is it a hard fork?

The term “fork” conjures up an image of a blockchain entity branching into two, which is correct but can sometimes be unhelpful.

A fork is essentially about rules, and the key fact that blocks produced under a new set of rules will not be compatible with blocks made under the old rules. Due to the five EIPs bundled into Constantinople, upgraded nodes will begin to produce blocks that are not recognized by nodes running the older version of the software and vice versa.

In all likelihood, almost all Ethereum nodes will eventually move over to the upgraded version (though perhaps not by the deadline). In effect, there won’t be a second viable blockchain, hence Buterin’s comment.

Related: What We Know About the Vulnerability Behind Ethereum’s Rollback of Constantinople

What changes will be made?

Four of the five EIPs included in Constantinople contain technical optimizations which, although important for the continued development of the network, will not have much impact on an average end user.

Among these changes are EIP 145, which allows bitwise shifting in the Ethereum virtual machine, making a certain class of arithmetical operations much more efficient to process; EIP 1014, which allows developers to interact with Ethereum addresses that have not yet been created; EIP 1052, which introduces an opcode (a low-level programme instruction) for retrieving the hash of a smart contract’s code; and EIP 1283, which changes how gas metering (the price users pay for running transactions or smart contracts) works in some situations.

It’s the fifth change, EIP 1234 that is most controversial. This proposal reduces block rewards from 3 ETH to 2 ETH: a 33 percent drop in the payout to miners that has become known as “The Thirdening.”

Effectively, miners are an unintended casualty of the block reward decrease.

The intent behind the Thirdening is to adjust inflation levels, since block rewards are the only way that new ETH is created. As helpfully calculated by Ethereum development studio ConsenSys, the final effect will be that the daily rate of increase in ETH supply will reduce from 20,300 to 13,400, or from 7.4m ETH per year to 4.9m ETH per year.

Considered as a proportion of ETH already in existence, this translates to a drop in yearly inflation from 7.7 to 4.8 percent.

Effectively, miners are an unintended casualty of the block reward decrease. It’s not a measure being taken specifically to deprive them of income, but there’s no other way to slow the rate of ETH production. Undeniably though, the timing is less than ideal, with ether currently trading at close to $130, only 10 percent of its market value on the same date last year.

For miners, whose motivation is generally to maximize returns for whatever hardware and electricity price they can obtain, a decrease in block reward equates to a decrease in profit. What remains to be seen is whether miners will exit the Ethereum network and switch their resources to another blockchain. A lot of eyes will be on the network hashrate once the upgrade takes effect, as this indicates how many miners are operating.

Will it be okay?

The short answer: It’s hard to say.

The longer answer: It’s probably fine, depending on what metrics for progress you use and which information sources you consider to be accurate.

With the fork just days away, only 15.6 percent of Ethereum clients have upgraded to software compatible with the fork, according to ethernodes.org’s forkwatch tracker. This seems like a worryingly low number, and it would certainly be cause for concern if it represented readiness for the fork among key players in the network.

But the 15 percent figure may not tell the whole story. Afri Schoedon, a staffer at Parity Technologies and community co-ordinator for the coming hard fork, explained in a tweet thread that the figures cited by Ethernodes reflect the total number of devices communicating over the devp2p protocol, including many devices that are not connected to the Ethereum main network.

There is no provision for difficulty decrease, so already stretched miners may decide to exit the market.

Accounting only for mainnet devices, the upgrade rate is currently somewhere in the region of 44 percent, Schoedon wrote, which is an acceptable level provided the upgraded devices skew towards being miners, exchanges and block explorers, all of which play a critical role in supporting Ethereum.

What happened last time?

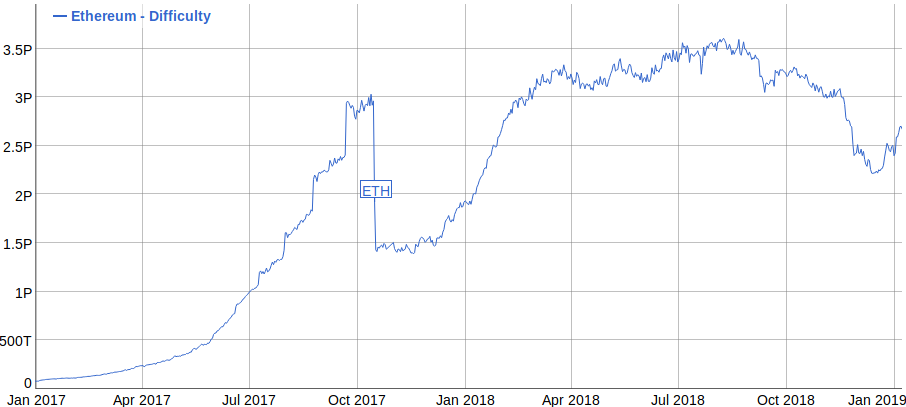

In October 2017, the Byzantium fork/upgrade was implemented on the Ethereum network, which among other things reduced the block reward from 5 ETH to 3. At that time, difficulty was decreased, meaning that miners were able to solve blocks more quickly and claim the lower reward more frequently than before. As a result, participation in the network remained stable. In the coming hard fork, there is no difficulty decrease, so already stretched miners may decide to exit the market.

Over the long term, Ethereum developers are unlikely to be concerned by this, as Constantinople marks just one progress point towards a proof-of-stake mining system that would eliminate proof-of-work mining entirely. But in the short term, with the Ethereum Classic 51 percent attack fresh in the memory, a significant drop in network hash power would create some unease around network security.

With a lot of moving pieces, the aggregate effects on price, difficulty, and participation are hard to predict. The lead-up to a hard fork is often filled with apprehension, but ultimately, the resilience of Ethereum is unlikely to be challenged.