Twenty years after Ebates first gave shoppers the option to get cash back for making purchases online, a new company called Lolli is looking to emulate its rewards model—but this time, with bitcoin.

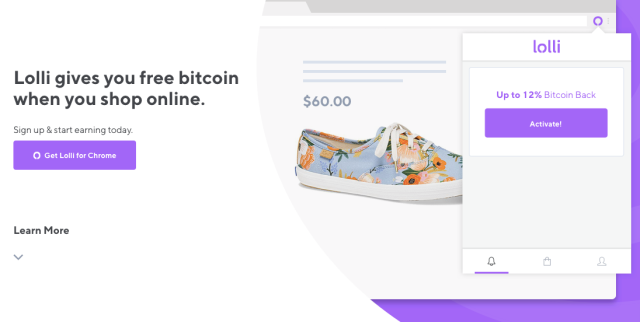

Lolli, the self-proclaimed “first bitcoin rewards application,” functions as a browser extension that allows users to earn a percentage of bitcoin back when they buy products online from select brands. The company currently has more than 750 participating partners, ranging from traditional department stores like Macy’s and Bloomingdale’s, to trendy millennial shops like Everlane and travel companies like Priceline. Lolli first debuted in September 2018 and since then several other crypto browser extensions have emerged, including Moon’s new Lightning-enabled service.

Founder and CEO Alex Adelman said Lolli is intended to raise awareness about bitcoin for retailers and consumers alike in order to promote wider cryptocurrency use. His goal is to make bitcoin more accessible by creating an option “where people could have skin in the game without all the risk,” he said, citing the often cumbersome process of mining and purchasing.

“I am a big believer in bitcoin and its ability to connect the entire world through commerce,” said Adelman, who also started the lifestyle e-commerce company Cosmic, now owned by PopSugar. “It’s the first asset I’ve seen where almost anyone in the world can use it, trade it between each other, and hold it as a store value. If you look at how we’re all connected through social connections, the closest ties are when we’re bonded together through commerce.”

Related: I Ordered Lightning Pizza and Lived to Tell the Tale

The percentage of bitcoin shoppers can receive is determined and paid out individually by each retailer, but generally is between 0.5 to 10 percent. Similar to traditional rebate companies like Ebates, Lolli gets a cut of each purchase via affiliate linking to e-commerce sites through its browser extension. Once a transaction is approved, bitcoin is saved to a user’s personal Lolli wallet and they can transfer the value to a bank account of bitcoin address after acquiring a reward value of $15 (0.0029 BTC) or more.

The premise sounds simple enough, especially for consumers (like myself) with a base knowledge of bitcoin, but who aren’t using it on a regular basis. Eager to get my hands on some bitcoin of my own, I downloaded Lolli and decided to give it a go.

Once its vibrant purple logo appeared on my Google Chrome browser, I scrolled through Lolli’s brand directory and perused a few e-commerce sites before settling on Barnes & Noble. Despite the mounting pile of books collecting dust on my nightstand, I added an essay collection from my reading list to my shopping cart. Perhaps the promise of being a future bitcoin titan might amplify my reading frequency, I thought, as I reached for my credit card.

After checking out like I normally would, I waited with anticipation for my Lolli wallet to fill with my infinitesimal 0.00010 BTC reward, only to find it still empty. Three weeks later, I’m still waiting. Turns out, users must wait until the return period is over—anywhere from 30-90 days, depending on the retailer—in order for the transactions to be approved and to receive bitcoin. While this ultimately protects the brands from consumers scamming them out of bitcoin, the delay doesn’t bode well for members of the instant gratification generation like myself. However, all said and done, it was an easy, unfettered way to score a bit of bitcoin.

Get the BREAKERMAG newsletter, a twice-weekly roundup of blockchain business and culture.

Regardless of reward delays, Lolli has amassed 10,000 users in its first six months and Adelman said it continues to grow rapidly. Though Lolli is currently only available on Firefox and Google Chrome, the team is working to expand to other browsers, as well as to develop a mobile app.

The growth of Lolli, as well as other rising retail-oriented companies like BitRail—which builds blockchain infrastructures for brands to develop and manage their own cryptocurrencies—points to an effort to make bitcoin more mainstream by educating both brands and consumers about its use.

Cameron Chell, founder and CEO of BitRail, said brands using their own currencies can help cut down payment processing costs, while providing valuable insights to build out loyalty programs and assist with regulatory compliances. Chell has recently helped companies like Kodak develop its own cryptocurrency, taking a cue from businesses like JPMorgan which launched JPM Coin in February and Facebook’s FaceCoin, which will supposedly debut later this year.

Chell said the most important part of democratizing cryptocurrency is building optimized experiences that provide a simple way to use bitcoin. He said companies like Lolli provide an important value to onboarding companies and consumers to bitcoin usage. “Blockchain and cryptocurrency are really better utilized and designed as mainstream tech,” he says. “Everybody needs to see that the technology works first and that there are useful cases, and once that’s the case, you can look for ways to make it easy to adopt.”

Though most of Lolli’s brand partners don’t currently accept bitcoin as currency, Adelman is optimistic this will soon change. “For many of [brands], we had to take something they were familiar with, like point systems and reward systems, to educate them around the power of bitcoin and why it’s important for generating sales and attracting new customers,” says Adelman.