I first laid eyes on Tron Black at Off Chain, a crypto-meets-preparedness conference in Salt Lake City. He rolled into his presentation on a Onewheel—one of those weird electric balance board things—and wearing a black, long-nosed crow mask. He then smoothly dove into a lighthearted but detailed look at Ravencoin, the blockchain he oversees as Lead Developer.

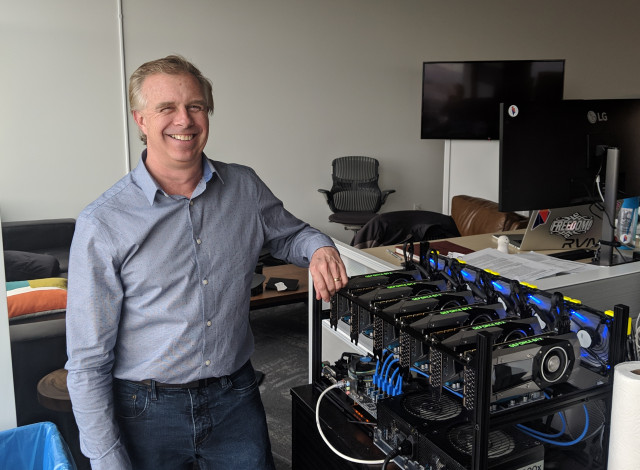

Black can be goofy, but he’s also got a track record as a tech developer and entrepreneur stretching back to the dawn of the internet, and he’s still on the leading edge. Black’s role in Ravencoin is part of his larger job as Principal Software Developer at Medici Ventures, a crypto incubator/venture fund. Medici runs largely under the umbrella of (and shares office space with) Patrick Byrne’s Overstock.com. Medici has roughly 20 crypto startups in its portfolio, and Black provides advice and hands-on help to many of them.

We sat in a conference room at Overstock and talked about Black’s life, his work, and his outlook. Our conversation has been edited for clarity and length.

You’ve been involved in crypto for a long time—since 2013. How did you learn about it, and what was it that motivated you to get involved?

I’ve been an entrepreneur most of my life. I’d started and sold a couple of internet companies back in the ‘90s. Blue Squirrel was a kind of meta-search tool, back before Google. We had a print utility called Clickbook, that’s still out there.

And then I was interested in political stuff that was going on. I heard about bitcoin in the context of Cyprus, where they basically closed the doors to the banks [in 2013] and said, ‘We’re gonna take some of the money.’ What it did was it told everybody, ‘Whoa, when we put money in the bank, it really isn’t our money.’ So I started going down that rabbit hole. And I couldn’t get enough of understanding [crypto], how it’s able to be distributed and can’t be stopped. It’s super fascinating.

Part of your tech startup experience was with very early online payments systems.

Yeah. As part of building internet utilities, we were one of the first to take credit cards for software [online]. This was back in like, ‘92-’93. We’d written modules that plugged into websites, and then, because it was so early, connected to dial up software that emulated the credit card being swiped. Our software would connect websites to a dial up system to clear credit cards in somewhat real time.

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

So the idea that you could now just pay through this [cryptocurrency] and have no bank involved? It was just amazing. Because [with credit cards] you had various tiers, and everyone taking a chunk along the way. And we had dealt with payment reversals.

So you pivoted into crypto.

I had the opportunity to be in this new field and do something. So the first thing is, what are the big problems? And I realized that it flipped the trust model. If I send crypto to somebody, and I want to get a bottle of hot sauce, or socks or whatever, I have to really trust that the person on the other end is going to send those, otherwise the money’s gone.

So, I felt like there needed to be something that was the equivalent of eBay ratings for the merchants, and that was the first thing I started building. I wrote a paper in 2013 about flipping the trust model, and then started building this verified wallet. The problem was that, right about that time, there were bankers saying they wanted to get identity with every address, which is also kind of a no-no. In some ways it was what I was doing with the merchant, but not the individual, and I quickly realized that the ability for me to get the message out was going to be conflated with this firestorm about [user] identity. So I said, I need to change tack.

From there, how did you end up affiliated with Medici?

Well first, I pivoted to CoinCPA, which was bitcoin accounting, and I was doing contracting. I was in the Netherlands helping another company, and [Overstock CEO] Patrick Byrne was a keynote speaker. And during the Q+A, he said, I would like to build a parallel crypto equity—take Overstock’s public stock and make a a parallel equity offering on the blockchain. And I said, that sounds like a cool project. And that was in 2014.

So he was very far ahead of the curve.

Yeah, Overstock had started accepting bitcoin in January 2014. I wasn’t involved at that point, but I was very aware it was happening. I bought stuff [with bitcoin] that I probably didn’t need, just so I could support that effort. And later that year I heard him talking in the Netherlands, and I said, not only does that sound like a really cool thing, but I’m 10 minutes away from the [Overstock] office.

So it took a little while, but I was finally part of that project. It’s called OSTKP, and it represents a share of Overstock, and it exists and trades on the blockchain. It’s really the precursor to tZero.

And now you work on Ravencoin.

Right, I’m the Lead Developer for Ravencoin, which takes up probably most of my time. [But] because I work so much in the blockchain, I also get to help [with other Medici projects]—and I say ‘get to’ because it’s actually pretty cool. There’s about 20 portfolio companies.

Who created Ravencoin?

So, Bruce Fenton, we’ll call it his brainchild. He didn’t build it, but he came up with the idea of taking bitcoin and forking it—a code fork, not a chain fork—and using that code as the foundation, and adding the ability to create assets. Bruce is not a developer, but he hoped to have some developers help with that, in the spirit of open source.

And I think Bruce actually had hired some people to do it, or had some people volunteering, and they just kind of didn’t get it done. So he ended up talking to Patrick [Byrne] about it. And Patrick said, yeah, we have some people that might be able to do that. We have a whole building full of blockchain people. And so thankfully, I got to hear about it early on, and I said, that’s something that I want to be involved in.

I’m always curious about the governance and labor around these open source projects.

We have tons of volunteer people doing all kinds of stuff. The Discord, the Telegram, the [block] explorers, the asset explorers, the node trackers, stats, and all that kind of stuff. All volunteer. With the core code, there have been some volunteers, but a lot of the backing has come from Medici.

The governance is like bitcoin, meaning we could suggest changes to [the core code], but those changes would have to be accepted by a preponderance of the mining hash-power.

But it’s not something that you guys own or 100 percent control.

Not at all. The governance is like bitcoin, meaning we could suggest changes to [the core code], but those changes would have to be accepted by a preponderance of the mining hash-power. If we tried to change something crazy, it would probably be rejected.

How does an asset on Raven compare to an ERC 20 on Ethereum?

Virtually identical. The main difference would be that when you issue [an asset on Raven], you get a unique name, whereas on Ethereum, you get a contract ID, just basically a huge, huge number. [On Ethereum], someone could come along tomorrow and make one with the same name but a different contract ID, they’re kind of unaware of each other. So you can create a misleading [asset].

Has Overstock become a center of gravity for crypto development in Salt Lake City?

Right now it’s more like a whirlpool, we’re sucking everybody in—Medici acquisitions, and hiring talent, and training talent, and spinning people up on crypto. It will continue to be a whirlpool probably for quite some time. But I would expect this to end up at some point being similar to the way people leave Google to start something—having lots of startups [in the area] related to crypto.

Within Medici, what’s the relationship between the seed companies and the parent company?

It varies from company to company, but there’s a lot of cooperation. We provide advisory services, we provide development. I get to help in that—if they need me for crypto stuff, I’ll go to meetings and give them ideas.

And Jonathan [Johnson, President of Medici Ventures] is on the board of a bunch of them, and that helps. We also do a summit where we bring the heads of all those companies to this building. We go play Top Golf and have drinks, and find out where there are synergies, partner up and work together, and find places to learn from each other.

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

[Wine futures startup] Vinsent is a good example. They were out of Israel, they had a team in Israel and now they’re building a team here. And they’re building on top of Ravencoin, so the wine futures will be Ravencoin tokens.

You live in Utah, but you’re not Mormon.

Yeah, I grew up here, was not Mormon, but I had lots of LDS friends. I didn’t think much of it as a kid—the only difference was, I think in high school they would walk across the street to some building and have, like, a religion class I wasn’t involved in. But as far as living here, having a family-friendly, clean environment, I think the influence probably helps a lot.

What fascinates me is that it’s a way of life that is very regimented in many ways. I wanted to have a drink the other night because I’d been on a plane. So I went to the state-owned liquor store, since that’s the only place you can buy liquor.

Yeah, there are a few weird laws we have here. Most of them were fixed for the Olympics in 2002, but there’s still some weird ones. Like, you can’t have two drinks in front of you at a restaurant. Just little weird things.

But the drunk driving rates here are way lower than anywhere else in the country. So I think it’s a great illustration of, if you have restrictions on things, it can impact everyone’s safety. And there’s a certain advantage to that.

Yeah, I am by far on the freedom side, very much on the libertarian side. I think the government imposes way, way, way too many rules. That ranges from SEC rules that are still in place from almost a century ago, to, you know, just seatbelt laws. I like education, not enforcement. And that plays into this idea that [cryptocurrency] is a permissionless system that can’t really be shut down.

You mentioned SEC regulation . . . what are the things that you personally see as outdated?

I look at things from a zero base. Instead of saying, ‘Well, you know, that’s the way it has been,’ I look at it from a systems perspective and say, how should it be? And when I look at things that were conceived in 1933 and 1934, especially where you put hard-coded numbers in there. Like, up to 35 people can invest—where did that number come from?

Or another number: There’s 2,000 holders of record before you have to register [with the SEC]. That probably made sense when every holder, somebody was writing it down with a quill pen. It doesn’t make as much sense as soon as you had Excel, and it certainly doesn’t make any sense when you have a registry that can self-manage, without any human intervention, and be perfectly accounted for, 100 percent, no errors.

So those things, they just seem outdated to me. This mismatch between technology and these rules, it’s tricky.