There’s a lot of excitement about crypto games. Add blockchain and get “digital scarcity” (items that are provably rare) in games for the first time. Allow free markets for game items so users can trade with one another for real money. Bring your items from one game to another. Games are a big (and growing) market and adding crypto to them should be huge!

The early success of games like CryptoKitties and Gods Unchained rely on these benefits. In both cases, items are issued in a predictable way and players can verify the supply (total number of) a given kitty or card by looking at the Ethereum blockchain. And trading these items to earn real money are a, if not the, primary attraction for players.

I think crypto games could be big, but I’m more skeptical than most. I’ve previously written about how there’s not much incentive for game developers to tokenize their game assets because it’s against their interests—it goes against their brilliant business model. And I’ve written about failed experiments in enabling real-money markets for in-game assets (like the Diablo 2 real money marketplace). Players have less fun when they have to think about real-world value. Basic logic pours cold water on the dominant narratives around crypto-games.

This line of reasoning might lead one to the conclusion that simply adding crypto to existing game models is more likely to fail than to work. I think that’s probably true. The lack of hit games (outside of pure gambling) that look like the hit non-crypto games is an existence proof (if adding crypto really made games better, they’d already be winning the market).

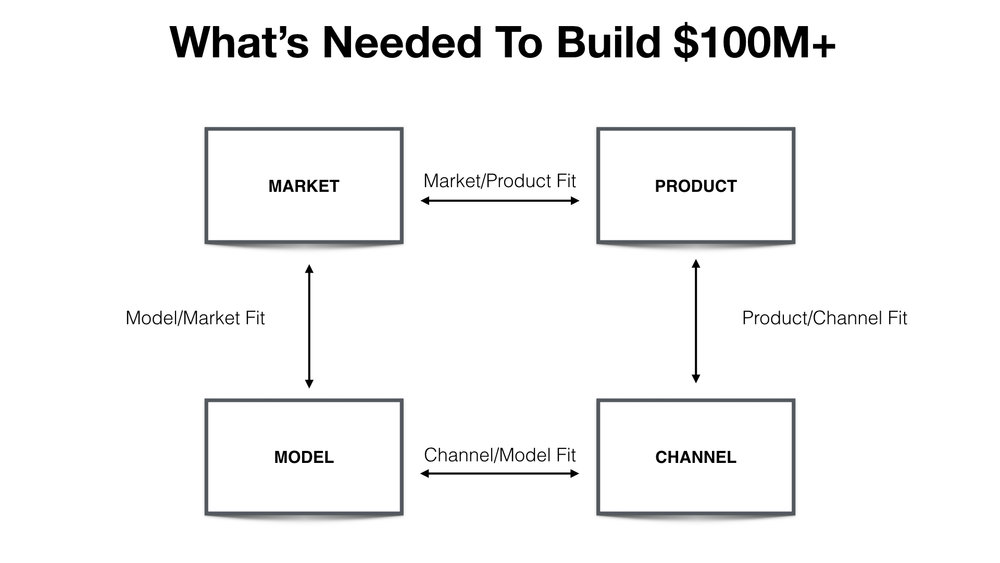

But does that mean that all attempts to design games around the properties of blockchains will fail? I don’t know. But I’d like to offer a framework to think about it: growth expert Brian Balfour’s The Four Fits.

The Four Fits demonstrates the relationships between (1) Market, (2) Product, (3) Channel, and (4) Model. Balfour uses it to describe what the relationships look like when a company grows fast and easily and what it looks like when it doesn’t (or fails completely). The general idea is that the four components need to have a harmonious relationship.

- The product needs to fit the market by offering something the market wants

- The model needs to fit the market so the business can match their monetization with users

- The channel needs to fit the model to lead to a viable monetization strategy

- The product needs to fit the channel so the users in the market are positioned to receive the product

You might notice the only thing that doesn’t have to fit something else is the market. That’s out of your control. So the product and model are dictated by the market and the channel is dictated by the resulting model. Then, if the product fits the resulting channel, you have a harmonious set of fits and growth will be relatively easy.

When we talk about “adding crypto” to games, it upsets the balance of game models that already work.

Here’s an example from VC Ben Horowitz’s great piece on distribution channels:

- Box sells enterprise cloud storage (product)

- Their product fits their market of enterprises with cloud storage needs

- Their model—large subscriptions of multiple “seats”—fits their market of enterprise users familiar with this business model

- Their channel—high touch direct sales—fits their model of large accounts

- And their product fits their channel; their salespeople can sell it well by directly selling to enterprises

Now let’s apply the same thinking to a hit game like Fortnite:

- Fortnite offers a free-to-play battle royale game (product)

- Their product fits their market of first-person-shooter gamers that like the battle royale genre

- Their model—purely cosmetic in-game item sales—fits their market of gamers happy to spend money on things that add delight to their game experience

- Their channel—a mix of viral and paid acquisition-fits their model of a huge player base that monetizes at a rate higher than their costs to acquire the player

- And their product fits their channel; they distribute Fortnite for free on all platforms to a huge, existing install-base (PC, phone, and console owners).

When we talk about “adding crypto” to games, it upsets the balance of game models that already work. For instance, tokenizing Fortnite skins changes the model which may break the channel. In this post, I suggest that tokenizing the skins would decrease revenues per player. If that were the case, Fortnite’s channel may need to adjust in turn (e.g. turn off paid acquisition).

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

It can be worse when adding crypto impacts the product itself. For example, a collectible card game will face balance issues if they only sell a small, non-inflatable number of rare and powerful cards (not everybody can own the powerful card, so players compete on an un-level playing field). This might change the market they can go after (from a large number of casual gamers to a small group of hardcore gamers willing to pay to win), and if the market changes, the model may have to change with it. In this case, they’ll probably need to raise prices to achieve comparable revenues. And if they raise prices, they may need to change their channel. At the end of the day, they may find that their product no longer fits their channel. Growth will be hard.

So some crypto games are facing game balance problems (like the above) and I’d say most are facing Four Fits balance problems. Adding crypto changed one of the four fits—usually model without balancing the rest. Or the impact of changing one of the fits led to poor fit overall.

The reason gambling games do well is that adding crypto doesn’t change the balance of the four fits. The product still goes after a gambler market. Their model is to take a familiar fee. Their channels can be the same. And the product fits the channel.

Balancing The Four Fits is what crypto games need to succeed. And because balance requires that components of The Four Fits respond to changes in any given component, the crypto games that succeed won’t look like legacy games with a crypto twist. Instead, they’ll look either exactly like legacy games in the case of gambling games, or really novel, with new combinations of product, market, model, and channel.

Tony Sheng publishes biweekly on the business and strategy of crypto. He leads product at Decentraland, a virtual reality platform, and makes investments in early-stage companies.