Bitcoin is dead. Bitcoin is booming! Bitcoin is a scam. Buy bitcoin now! Twitter loves bitcoin. Twitter bans bitcoin ads!

The tone of the first cryptocurrency’s media coverage has fluctuated like its prices. In honor of bitcoin’s 10-year anniversary, let’s take a look back at the headlines that at turns declared bitcoin’s death and resurgence (but mostly death), each time with equal fervor.

The coverage starts off slow, citing notable bitcoin usage on Silk Road, the dark web marketplace that helped launch bitcoin onto the public’s radar in mid-2011. From there, bitcoin burns and rises from its ashes time and time again, like a majestic, digital phoenix that just wants to one day be reborn into a world where currency isn’t subject to government regulation and people can pay their friends back for lunch without a centralized intermediary.

From its humble origins as the “currency of the geeks” to the top choice for criminals, from a “joke” to pure “evil,” from soaring values to popped bubbles, follow us on the rollercoaster journey that has been the public’s perception of bitcoin. As you read the following selection of salacious bitcoin headlines (“selection” because there were far too many to include them all), remember that they emerged from an unassuming, eight-page white paper released to the public on October 31, 2008.

2008-2010

All is quiet on the bitcoin media front. You can hear whispers about the digital currency if you put your ear to online forums and listen closely, but in the mainstream media, the silence is deafening. This is not surprising, as bitcoin only starts to gain value a few months into 2010.

2011

June 6, 2011: “Bitcoins: Currency of the Geeks,” Bloomberg

It is not yet gauche to talk about “bitcoins” in the plural. No one knows any better. No one, that is, except for the geeks. Like the geek(s) who started the Silk Road a few months prior, in February 2011.

June 15, 2011: “The Bitcoin Business Is Entirely Out of Hand,” The Atlantic

A “hacker thief” steals $500,000 worth of bitcoin, “supposedly.” There’s “bad news for bitcoin,” there’s a bubble (the first?), and there are poor cases for its “legitimacy.” But ultimately, “if enough people bet on it,” bitcoin’s got a shot in hell at adoption. Maybe, just maybe, it will last another five days.

June 20, 2011: “So, That’s the End of Bitcoin Then,” Forbes (contributor)

Or it won’t. This Forbes contributor, a fellow at the Adam Smith Institute in London, thinks bitcoin doesn’t have much “going for it” after prices on Mt. Gox, the first major bitcoin exchange, plummet due to a security breach. (Mt. Gox service is restored…for now.)

November 23, 2011: “The Rise and Fall of Bitcoin,” Wired

Papa John’s and farmers start accepting bitcoin. It’s on the rise. Early bitcoin developer Gavin Andresen speaks to the CIA about the digital currency. People are thrilled to announce that they threw away what could have been hundreds of thousands of dollars by using bitcoin to buy pizza several months too early because the pizza was “really good.” But there are “troubling signs,” like the potential to use bitcoin to launder money and illegal purchases made with bitcoin on the Silk Road. Schemes follow, and viruses. The wallet service MyBitcoin stops responding to users’ emails, and users don’t get their bitcoin back. Has Satoshi Nakamoto “forsaken its adherents”?

2012

September 5, 2012: “$250,000 Worth of Bitcoins Stolen in Net Heist,” NBC News

Bitcoin exchange Bitfloor goes under in a hack, with users losing a total of around $250,000 worth of bitcoin.

September 9, 2012: “FBI Fears Bitcoin’s Popularity With Criminals,” Wired

No more innocent pizza-buying and lunches in Midtown. Bitcoin popularity is back among the black tar heroin buyers and cyber criminals, according to a leaked FBI report.

December 24, 2012: “Wired, Tired, Expired for 2012,” Wired

“At the height of its popularity, Bitcoin was trumpeted as a viable alternative currency for the internet age, a monetary system engineered to prevent theft, gaming, and criminalization,” writes Wired. “Then came the malware, the black market, the legal ambiguities and The Man. Today, you can’t even use it to buy Facebook stock.”

2013

February 8, 2013: “Y-Combinator Backed Coinbase Now Selling Over $1M Bitcoins per Month,” VentureBeat

Forget the shady bitcoin exchanges of yesterday, like Bitfloor. Coinbase has arrived and it’s thriving, with nearly 40,000 users making around 30,000 transactions per month.

April 1, 2013: “The Bitcoin Boom,” The New Yorker

Bitcoin values spike, all the way up to $65 per coin.

April 3, 2013: “Four Reasons Why You Shouldn’t Buy Bitcoin,” Forbes (contributor)

Spike or no spike, bitcoin still has scaling, regulation, and application issues.

One of the early bitcoin "bubbles" arrives as the price of bitcoin climbs to $260, its highest value yet. This prompts Business Insider to insist that "Bitcoin Is a Joke" on November 6, 2013. The author uses a handy visual aid to hit his point home. (Image credit: REUTERS/Eliana Aponte)

November 20, 2013: “Bitcoin Is Still Doomed,” Bloomberg (opinion)

Bitcoin prices keep climbing and regulators speak to Congress about the digital currency. This, Bloomberg assures us, does not actually bode well for bitcoin.

November 27, 2013: “A Prediction: Bitcoin Is Doomed to Fail,” The New York Times

The equivalent of one bitcoin nears $1,000. The media gets increasingly wary of a non-government-issued currency.

December 28, 2013: “Bitcoin Is Evil,” The New York Times (opinion)

Bitcoin dips back around $700 per coin, and “bubble” remains the word of the day.

2014

TechCrunch embarks on a several-month period of monitoring the dollar price of bitcoin…

Uh-oh…

May 30, 2014: “Bitcoin Crosses the $600 Mark as Its Rally Endures,” TechCrunch

All is well in the world of bitcoin. Everyone, relax.

September 19, 2014: “Bitcoin Slips Back Under $400,” TechCrunch

Did someone say relax? TechCrunch notes an interesting phenomenon: “There has been an almost-paradox at play with bitcoin this year. As adoption has increased, and the constant media cycle asking if the currency will die has slowed, its price has slipped.”

September 22, 2014: “Is It Time to Invest in Bitcoin?” The Wall Street Journal

After all that, the media decides it’s worth taking a second look at bitcoin investments.

2015

Finally, enter fun bitcoin stock art thanks to The Telegraph's January 15, 2015 story, "Bitcoin Might Be Dead. It Doesn't Matter," following a recent low value for the digital currency.

June 8, 2015: “Bitcoin Isn’t the Future of Money—It’s Either a Ponzi Scheme or a Pyramid Scheme,” The Washington Post

Esteemed news outlets like the Post speculate as to what kind of scheme bitcoin is becoming. Whatever the answer, it “isn’t a currency.”

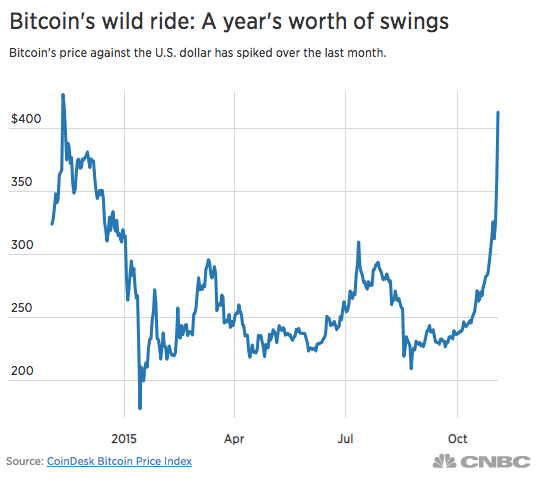

November 3, 2015: “Bitcoin’s Price Jumps More Than 70 Percent in One Month,” CNBC

Bitcoin is "on a roll." CNBC depicts its bumpy year.

December 8, 2015: “Man Buys $27 of Bitcoin, Forgets About Them, Finds They’re Now Worth $886k,” The Guardian

The pleasant surprises start rolling in as people realize the digital coins they bought for a number of cents in 2009 to buy drugs on the dark web are now cumulatively worth hundreds of thousands of dollars. That’s a lot of drugs—but no more Silk Road to buy them on. In fact, Ross Ulbricht, the marketplace’s main operator, was sentenced to double life imprisonment earlier this year.

December 29, 2015: “Bitcoin Is One of 2015’s Biggest Winners,” CNBC

This year saw bitcoin’s price go from just above $300 to $430. And people think that’s dramatic. They’re forgiven—it’s still just 2015.

2016

January 19, 2016: “RIP, Bitcoin. It’s Time to Move On,” The Washington Post

“Not long ago, venture capitalists were talking about how Bitcoin was going to transform the global currency system and render governments powerless to police monetary transactions,” writes the Post. “Now the cryptocurrency is fighting for survival.” This gloomy prediction comes about after bitcoin developer Mike Hearn calls bitcoin a “failures” and sells all of his. The price of bitcoin decreases by 10 percent.

March 2, 2016: “The Dream of Buying Coffee With Bitcoin Is Dying, If It’s Not Already Dead,” Motherboard

Turns out bitcoin’s barrier to entry is too high, and there aren’t enough adopters to get Starbucks to accept the digital currency. Cue Business Insider’s sad clown.

March 8, 2016: “Performing an Autopsy on the Bitcoin,” The Street

Move over, bitcoin. Ethereum’s the blockchain to be watching now, as it was “designed from its inception to be unlimited in size and scalability.” The poor, sad clown bitcoin blockchain was not.

June 6, 2016: “Bitcoin’s Rallying Again—But It Isn’t Getting Much Attention Anymore,” The Wall Street Journal (blog)

Bitcoin’s price is going back up, but apparently no one cares. Sigh.

"Is Bitcoin Doomed?" Newsweek asks on October 12, 2016, showing this oddly menacing picture of a Bitmain mining farm in Iceland (credit: Reuters/Jemima Kelly). Prediction: Newsweek will ask this question again in less than two years.

2017

January 5, 2017: “Why You Shouldn’t Invest in Bitcoin,” Time Money

“On Thursday, the value of a bitcoin reached $1,153.02,” the author writes. “However, later Thursday morning, prices suddenly fell by about $200.” This lackluster start kicks of bitcoin’s banner year—price-wise, at least.

March 3, 2017: “Bitcoin Value Tops Gold for First Time,” BBC

Bitcoin: $1,268. Ounce of gold: $1,233. Fiat-lovers can eat their hearts out thanks to a big surge in Chinese interest in the digital currency, even though Chinese authorities have started cracking down on bitcoin trading.

May 4, 2017: “Bitcoin Just Soared to a New $1,600 High—But the First Investor in Snapchat Thinks It Could Hit $500,000 by 2030,” Business Insider

The first Snapchat investor, Jeremy Liew, and co-founder and CEO of Blockchain, Peter Smith, predict that bitcoin will reach $500,000 per coin by 2030. If only such favorable predictions could come true about their own vested interests.

CoinDesk announces that "History Is Made: Bitcoin Prices Top $2,000 to Set New All-Time High," on May 20, 2017. Then history is made again about two months later, when CoinDesk makes a similar proclamation on August 5: "Bitcoin Price Surges Past $3,200 to Hit All-Time High."

September 8, 2017: “Bitcoin Is Dead, Long Live Bitcoin,” Motherboard

In spite of the major surge, or perhaps because of it, Motherboard still thinks we’ll never buy coffee with bitcoin.

December 15, 2017: “Bitcoin Buyers Should Be Prepared to Lose All Their Money, Top UK Regulator Warns,” CNBC

Andrew Bailey, chief executive of the Financial Conduct Authority, says lack of involvement from governments and big banks mean bitcoin is not a smart investment.

December 27, 2017: “Bitcoin Is an Implausible Currency,” Bloomberg

From $972 to $14,822 per bitcoin in one year does sound pretty implausible…

2018

March 3, 2018, “Is Bitcoin Doomed? Why Bankers Hate the Popular Cryptocurrency,” Newsweek

Recognize this headline? It’s because Newsweek used the same one less than two years earlier.

March 18, 2018: “Twitter Is Reportedly Planning to Ban Cryptocurrency Ads,” The Verge

Enter a brief Katy Perry “Hot N Cold” style relationship between Twitter and bitcoin.

March 21, 2018: “Twitter CEO: Bitcoin Will Be the World’s ‘Single Currency’ in Ten Years,” The Verge

“The world ultimately will have a single currency, the internet will have a single currency. I personally believe that it will be bitcoin,” says Jack Dorsey, CEO of Twitter and Square. Square has been flirting with bitcoin payments, after all.

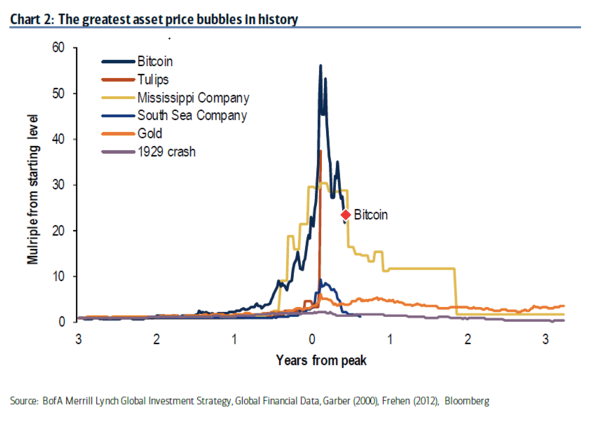

"Bitcoin, the Biggest Bubble in History, Is Popping," Bloomberg writes on April 9, 2018. Seriously, get that sad clown back here.

April 12, 2018: “Bitcoin Prices Surge by Roughly $1,000 in Just 60 Minutes,” Fortune

It’s speculated that “institutional investors” caused this one, or maybe a lot of people bought bitcoin after the recent increase to $7,000.

Bitcoin is a "colossal pump-and-dump scheme" used primarily by criminals, according to this April 24, 2018 Recode story, "Bitcoin Is the Greatest Scam in History." Sounds like we're back in 2012. (photo credit: Artyom Geodakyan / TASS via Getty Images)

June 24, 2018: “Bitcoin Falls Below $6,000. But Crypto Trader Says It’s ‘Not Dead,’” CNBC

It’s not dead, it’s just wounded.

June 30, 2018: “Bitcoin Has Fallen to Its Lowest Point Since November and Will Probably Be Totally Wiped Out,” The Independent

Like, wounded badly?

August 30, 2018: “Bitcoin and Other Cryptocurrencies Are Useless,” The Economist