The dire warning appeared in my inbox last night. The offer would “expire at midnight,” after which the opportunity to join Forbes’ “breakthrough advisory, Forbes CryptoAssets & Blockchain Advisor,” will disappear “for good.”

The email starts off with an acknowledgment that “your time is valuable, so I’ll be brief,” followed by 2,792 words urging readers to invest in crypto.

Forbes has made a number of promising moves surrounding their crypto coverage as of late. Sure, the publication lost Laura Shin and her podcast, Unchained, but it also hired Michael del Castillo, who covered digital currencies for the New Yorker as early as 2013 and reported on blockchain at CoinDesk for over two years before leaving to head crypto coverage at Forbes. Then earlier this month, Forbes announced it would start publishing content on Civil’s platform, which would track and save information about the stories’ authors, their credibility, and the reliability of their sources. The move could balance out the “reporting” of those in the Forbes “contributor network,” many of who have vested interests in the projects or technologies about which they write.

The “premium newsletter” that Forbes is currently pushing came out of its efforts to become a go-to for blockchain coverage. The CryptoAsset & Blockchain Advisor letter would offer insight and investment strategies, serving as a trusted resource in a space riddled with marketing disguised as reporting. Its editor is Jack Tatar, a Marketwatch columnist, managing partner at a wealth management fund, and co-author of Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond, published last year.

This latest email, promising to help “ordinary investors like yourself” get “substantially larger gains then you’d ever make in conventional stocks and funds” reads like a departure from what was shaping up to be sane coverage of the blockchain space. Instead, it sounds like an extreme infomercial. Here are the seven most outrageous excerpts.

1. Bolded reference to bitcoin’s past gains.

“Chances are, you’ve heard of bitcoin and its incredible 1,000 percent gain in 2017,” the email reminds readers, putting in bold an exact calculation to remind us of those golden times. “That’s enough to have turned a $10,000 investment into $200,000.” Besides this sentence reading like an infomercial delivered by a red-faced man with obvious hair plugs, it’s also not a good premise for investing in anything. It certainly doesn’t support putting money in the “select group of crypto assets and blockchain companies in line for a massive windfall,” as the email aggressively suggests.

2. Transforming ANY industry.

We’ve all read the stories. “Blockchain Can Solve X” or “Blockchain Can Fix Y.” Forbes leans into this. “Because it creates a tamper–proof record more secure than any repository under the control of one entity, blockchain can simplify, streamline, and automate transactions for ANY industry—including finance, logistics, supply chain management, health care and much, much more.” Props on the use of a) caplocks, and b) “much” repetition to hit the point home.

3. Plug after plug after plug.

In case you forgot that this Forbes email was a rallying cry to pay for their newsletter, there’s a handy reminder—and another, and wait, keep reading—another! “What you need—what we all need—is a trusted source to guide us to the most rewarding opportunities,” writes Forbes, following up immediately with a link to subscribe. You don’t have to scroll too far to get to another one.

4. The infomercial lingo continues.

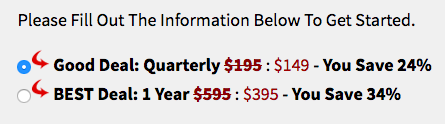

“Plus, to make sure you’re positioned to take full advantage of this revolution, I’d like to send you a complimentary copy of [Jack Tatar’s] just–published report, Debunking 6 Bitcoin Myths, just for taking a no–risk look at Forbes CryptoAsset & Blockchain Advisor.” The only way to make this sound more like a Shake Weight™ advertisement would be to add an enthusiastic “for just $395 a year—that’s 34 percent off the usual rate of subscription!” (That’s actually how much subscribing to this newsletter costs.)

5. Very convincing quotes.

But don’t take Tatar’s word for it alone, other people also think blockchain is “here to stay”—like this one Wharton professor. “It’s a new broad approach to network-based infrastructure that can be applied to just about anything,” Forbes quotes professor Kevin Werbach.

Read that quotation again. Perhaps blockchain “can be” applied to pretty much whatever, but should it? Here to stay or not, possible applications alone do not a solid investment make.

6. “To repeat: Virtually nothing can derail this technology’s momentum…”

NOTHING. Not climate change, not a zombie apocalypse, not swarms of locusts, and certainly not pump-and-dump schemes and supposed “crypto experts” who tell new investors in the space which supposedly fool-proof stocks they should not hesitate to buy RIGHT NOW.

7. Shhh, a magician doesn’t reveal his tricks…

What great assets should crypto noobs start investing in? Uh uh, only those anointed with a subscription to Forbes’ newsletter can know. The rest of us will have to remain satisfied with a cryptic message about “the mother of all cryptocurrencies”—which could be on the course of a “truly fiery run”—as we speculate about “the most future-proof coin?” (Punctuation by Forbes.)

So what are you waiting for? For just $394.99—I repeat, just $394.99—you can get your very own, no-risk subscription to Forbes CryptoAssets & Blockchain Advisor today! That’s a 100 percent confirmed guaranteed expert bringing fool-proof blockchain stock picks right into your inbox, and all of these stocks are HERE TO STAY. But wait, there’s more! “Gains of 1,000 percent or more are not just possible, they’ve already happened with the very first application of this technology.” And remember folks, this technology can apply to ANYTHING.

Order online now!