As usual in the blockchain space, there are two different ways to tell the same story—with willful optimism, or one eyebrow raised.

Both Deloitte and PricewaterhouseCoopers released their 2018 global blockchain surveys this week, and while there’s agreement that tech-savvy business executives are thinking about blockchain, a countdown until the technology’s “breakout” moment appears to be in dispute.

PwC offers the more guarded view, focusing on hurdles established businesses will have to navigate before embracing a technology that’s still associated to some extent with criminal hacks and dark web drug deals.

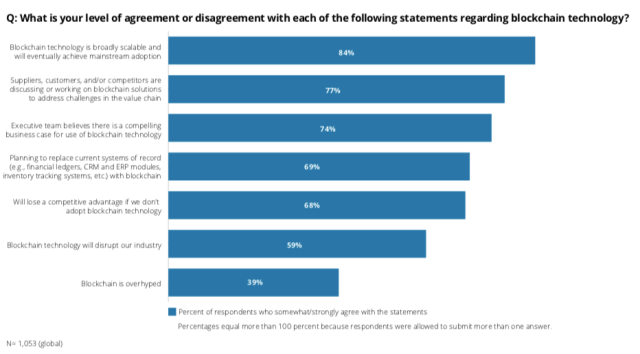

Deloitte waxes more optimistic, declaring that the breakout moment is getting “closer…with every passing day.” After surveying over 1,000 “blockchain-savvy” executives at established companies (aka, not startups) across seven countries (the United States, Canada, Mexico, UK, Germany, France, and China), Deloitte found that 74 percent think there’s a “compelling business case” for blockchain technology, while 34 percent are already working on some kind of blockchain implementation. Sixty-eight percent worried their companies could lose their competitive edge if they don’t hop on the blockchain bandwagon.

From Deloitte's report

PwC surveyed 600 executives across 15 territories, 84 percent of whom said their organizations were already involved in some way with blockchain tech. Most said they were in the “development” phase (32 percent), while 15 percent already had live blockchain projects.

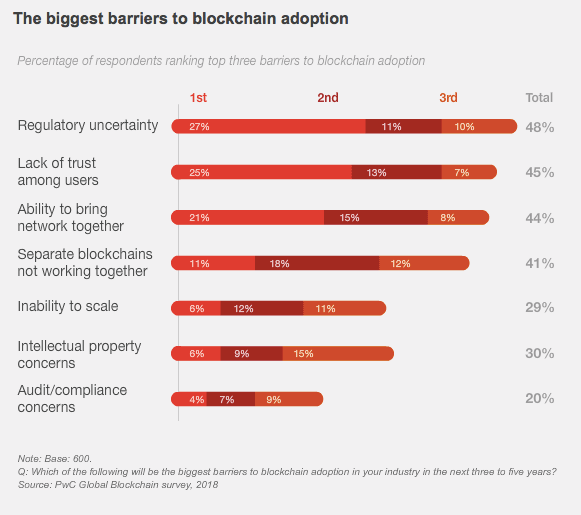

From PwC's report

Looking at the numbers of those interested and working on blockchain projects alone, the two surveys gathered similar results: Most tech-savvy executives at the established businesses surveyed believe they should be seriously considering the use of blockchain technology, across industries ranging from financial services to retail, automotive, and government (but mostly financial services). This reflects the general outpouring of announcements that X company in Y industry is partnering with a blockchain company to solve Z problem.

It’s the questions Deloitte and PwC chose to ask respondents that put their conclusions at odds.

Even though PwC found more respondents’ organizations were actively working on the tech, the research firm focused largely on the skeptics’ angle. Survey-takers were asked whether issues like “regulatory uncertainty,” “lack of trust,” and “intellectual property concerns” would prevent adoption. Regulatory uncertainly proved the most troubling to executives; next came trust issues. “Blockchain, by its very definition, should engender trust,” reads the report’s conclusion. “But in reality, companies confront trust issues at nearly every turn.”

PwC's "barriers to adoption"

Deloitte didn’t seem too concerned about trust issues; instead it focused on “blockchain fatigue,” the syndrome whereby sufferers have grown weary of hearing blockchain hype without seeing any tangible, corresponding results. Close to 39 percent of Deloitte’s survey respondents believed blockchain to be “overhyped.”

Yet Deloitte is undeterred in its belief that “adoption remains promising,” in spite of the fact that projections from the company’s 2016 global blockchain survey seemed to imply that blockchain adoption and production “would have happened at a faster pace” than we’ve seen so far this year. “We see the potential,” concludes Deloitte, “for blockchain to help organizations create and realize new value for businesses beyond anything we can imagine with existing technologies.”

Still, hedging with terms like “potential” and “imagine” allow Deloitte to remain at least somewhat coy about whether blockchain is really hot…or not.