Jemma Green was working toward her sustainable energy PhD in western Australia when she noticed a discrepancy. While plenty of households in Australia had rooftop solar panels, condos didn’t.

Green wanted to change that, so she looked for technology that would foster energy trading in shared buildings. Say you were going on vacation for a week, and you wanted to give your weekly energy allocation to a neighbor in exchange for their share when they went away a month later. How could you establish something like that simply, reliably, and without having to trust too much in your neighbor’s good will? “I was struggling to find software that would create [that] environment,” says Green.

This story goes like so many others. Green’s search for the perfect software ended when she discovered blockchain, and her energy-sharing idea suddenly entered the realm of possibility. “Honestly, it felt like science fiction,” she says of her introduction to the technology. She’d only heard the term in relation to bitcoin before, but a quick online search revealed blockchain’s applications in the electricity sector. “It could create a real time agile trading and settlement environment” for energy, she realized.

Related: Is Brooklyn’s Microgrid Pilot the Future of Clean Energy?

Now, Green is the cofounder and chairman of Power Ledger, an Australian company that offers three energy-saving products that rely on blockchain. There’s the company’s “signature product,” uGrid, which enables the peer-to-peer energy trading Green originally hoped to establish. Then there’s an energy asset financing product, which Green says Power Ledger will launch later this year, called “asset germination.” The company’s third, main focus is on enabling wider carbon markets by helping energy companies manage supply and demand. Besides Australia, Power Ledger has sustainable energy projects running in the U.S., India, Japan, and Thailand, and it’s hoping to expand. After all, climate change isn’t going away, and Green’s hoping Power Ledger can play a significant part in reversing the damage humans have already done to planet earth.

We caught up with Green one early morning (Australia time) so she could explain why Power Ledger is able to set up peer-to-peer energy markets more easily in some places than others, what makes Australia so into solar panels, and how tech founders can get better at hiring women.

What’s the most effective way to sell people the idea of participating in a peer-to-peer energy network?

It depends on who you’re talking to. We sell B2B products in that we’re selling our technology to a utility who will offer it to their customers. The proposition for the retailer—the energy company—that may want to use our technology is slightly different from what it is for the customer. For customers, households with solar panels can sell their renewable energy to their neighbors, and they can get a return on their investment. It’s a win-win situation.

How much do you need to explain blockchain to customers in order for them to be able to participate?

Consumers don’t really need to understand the blockchain. They just know that they get a digital wallet with Spark in it. One Spark in one cent. It’s like phone minutes for electricity.

The utility needs to understand the blockchain and the technical integration process. So that can take some time, as does understanding the benefits of using the blockchain versus a traditional database. We get asked about that quite a lot.

Do you have a quick elevator pitch that you give them?

It creates a more real-time, agile trading market and settlement of the trade. Using our system, the customer knows what the price opportunity is in real time and can participate in it and be paid that same day.

Power Ledger already has partnerships in the U.S., India, Japan, Thailand, and Australia. What territories are you thinking of expanding into next?

We are looking at some additional countries. I’m going to Taiwan next month for a conference, and I’ve got a lot of meetings set up there.

We’re also looking at expanding in the countries that we’re operating in already. In Thailand, we’ve got just under one megawatt traded on the platform. In Q1 this year, we will add four more megawatts, then in Q2, 12 additional megawatts. In California, we have a carbon project with Silicon Valley Power. That’s got one electric vehicle charging station connected to the platform right now that’s eligible for carbon credits, but we’ll be adding additional assets to the platform to generate carbon credits this year.

In Perth, we’ve got the Smart City project with the federal government. And that’s currently got 40 customers that we chose to get the right scale to make sure everything works. Now, there’s a push to add 400 more users to the platform.

Quite interestingly, some developing countries are being more agile, and they leapfrog to a distributed energy markets faster than high income, big countries.

Are there any locations that are better suited for setting up sustainable energy systems than others, in terms of regulation or any other factors?

Yes. In Thailand, the government just announced that peer-to-peer trading, consumer to consumer, is now permissible. Prior to about a month ago, it was just commercial trading between commercial users. In India, they already have the ability to trade peer-to-peer enshrined in the legislation, so they recognize that it’s going to be a big part of the marketplace. Quite interestingly, some developing countries are being more agile, and they leapfrog to a distributed energy markets faster than high income, big countries.

But in the U.S. it still seems like you’re able to make plenty of headway.

Yeah, it’s a bit different in different markets. We’ve got that carbon project I mentioned in California, and then the Pennsylvania project. Then there are certain markets, like the Texas market and the New York market, which are more deregulated, which make operating the energy platform more feasible.

Most of the states in the U.S. operate a carbon market, so there’s more application for that particular technology there. In Australia, interest in carbon markets has been waxing and waning over the past decade. But we have a federal election in March, and we may see a more stable carbon policy emerge.

It does seem like there are a lot of blockchain-based the sustainable energy and microgrid projects developing in Australia, like LO3. Why is that?

We have a lot of sunshine—in Perth, nearly 300 days of it every year. We also have the second highest electricity prices in the developed world to Germany. In the States, you might pay 10 to 13 cents per unit of electricity, whereas here you pay around 30 cents.

You said in an October 2018 SmartCompany article that you think Power Ledger can “play a decisive factor in helping meet the Paris Agreement climate change goals.” Can you think of any other blockchain projects that you’d say the same thing about?

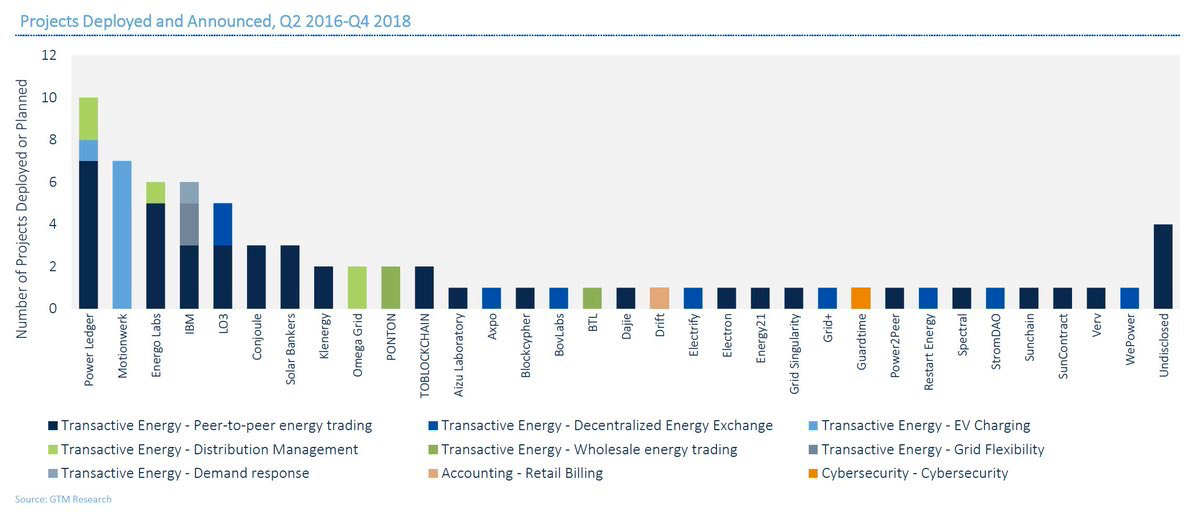

In the overall space there’s probably 15 companies that are operating in this area.

There’s LO3, and then there’s Energy Web Foundation, which is actually a consortium of some utilities together. WePower is another one. [Green’s seven-month-old begins to cry in the background.]

I’m happy to pick this up later if that’s easier…

As long as you can hear me, I’m okay. I actually have my child in the office with me every day. I have a seven-month-old, and he’s been coming to work with me since he was seven weeks old. My three-year-old came on 25 business trips with me when she was under two, and my seven-month-old has already been to Thailand, to Richard Branson’s Island. [Power Ledger won Richard Branson’s Extreme Tech Challenge last year.] It’s a little chaotic, but I couldn’t do the work that I do if I was so far away from my kids. I would feel sad and bad.

A second staff member is actually about to have a baby. I’m so excited because we’re moving offices, and we got a space now where it’ll be much easier for people to bring their children into the office.

I’ve heard Power Ledger employs an equal number of men and women. Is it actually a 50/50 split?

Yeah, it is.

Was that a conscious hiring decision, or did it just shake out that way?

I just happened that way. We’ve been trying to hire a woman programmer, but we don’t want to just hire someone who’s a woman; we want to hire the best candidate. We haven’t found a candidate that fits the brief yet from a programming perspective, so we’re continuing to look.

If you could give other founders or CEOs tips on how to hire better for diversity, what’s some of the best advice you could give them?

I think that in tech, there are fewer women in the space, so you have to spend more time trying to find top talent women to get them into the application pool. You might have to post a job in different forums and places, like in women in tech groups on LinkedIn and Facebook. I’m in three different Telegram groups that include women, and they’re very active. Last weekend I attended a female coding hackathon. There were 160 women there learning to code. You can find women more readily, but you have to put effort into creating a pool of applicants and then hire the best candidate.

You mentioned in a recent Huffington Post article that you see yourself as a role model for women in tech—is there a distinction between that and being a role model for women in blockchain, specifically?

I don’t necessarily distinguish them. Blockchain is a more rapidly growing field, so it’s able to bring more people into the space. There’s the potential for women or anyone to become more expert more quickly, and so it’s perhaps more accessible, but I think that both face similar challenges.

I wrote an article in Forbes about how some of the original programmers in technology where women. I think the challenge is to really re-position the type of person that can be in the field as a woman. Having those role models means women can see, Oh, people like me are in this sector. I spend a lot of time going to events trying to advocate for women in the space and empower them.