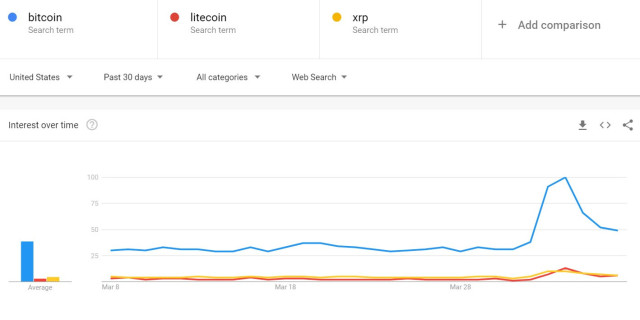

Daily search interest in “bitcoin” nearly tripled between March 31 and April 3, according to Google Trends, before receding for the past four days. Searches for related terms, including “cryptocurrency,” “Litecoin,” and “XRP” also rose sharply before dropping, but bitcoin has thorough brand dominance, with around eight times the search volume of other terms. On a weekly basis, “bitcoin” searches doubled between the last week of March and the first week of April. Google provides relative search levels, not actual search numbers, but these are the highest relative levels since late November of 2018.

The rising search interest has already been widely highlighted by crypto media and observers on Twitter, usually with an implicit understanding that search interest has a positive relationship with the past week’s huge price rally. Bitcoin has risen by more than 20 percent over the past week.

But what exactly is the nature of the relationship between search interest and cryptocurrency prices? Most importantly (for some), can it help predict where bitcoin’s price is heading?

In traditional investing terms, this means asking whether search interest is a “lagging” indicator or a “leading” indicator. There’s no universal agreement on these things, but at least according to conventional wisdom, the stock market and retail sales are leading indicators, with drops warning of a coming recession; while unemployment and (obviously) GDP are lagging indicators, only shifting after the economy has already switched gears.

So, is crypto search interest a lagging or leading indicator? In other words, are people searching “bitcoin” because they have decided independently that they want to buy some, which would in turn suggest a continued price rise? Or are they searching bitcoin because they heard about the price going up?

Right now, we’re seeing search leading price: Though search has slumped considerably over the last five days, crypto prices have continued climbing after the initial search spike. But historical data shows that, over the longer term, search levels have frequently lagged price, including at one particularly crucial moment we’ll dig into.

Think about it for a minute, and you’ll grasp why search doesn’t have the clearest directional relationship to price in crypto. People who hear crypto prices are rising, then perform a Google search to learn more, may in turn become buyers themselves. This is one explanation for why bitcoin bull cycles can be so intense, as we saw in late 2017—search interest both reflects and fuels rising prices.

It’s a simply ferocious cycle. It’s also, as we’ve detailed recently, a dangerous trap if you actually have long-term investment thesis around crypto in general, or specific digital assets.

There’s even a second amplifying factor: the financial news business. Traffic is a major priority for many sites that cover the economy, stocks, and investing. In fact, here’s a dirty secret: Most sites that depend on traffic pay at least some attention to Google Search trends to guide their coverage. Rising interest in bitcoin means sites will write more about bitcoin, and promote those stories on social media, in turn creating more awareness that bitcoin is rallying, more search interest, more buying, higher prices, more stories, and on and on and on.

It’s a simply ferocious cycle. It’s also, as we’ve detailed recently, a dangerous trap if you actually have long-term investment thesis around crypto in general, or specific digital assets. Smart investors don’t rush to buy into rallies, period.

But the people who aggressively buy crypto during rallies aren’t informed, sophisticated, or disciplined investors. One very interesting note about the recent search spike: The phrase “BTC USD” rose significantly less than searches for “bitcoin.” The first search would likely show current holders checking the value of their portfolio. The second is more likely to be coming from people who wouldn’t know a Merkle tree from an oak.

The irony here is that in a dumb market, it can pay to play dumb yourself. Broadening curiosity makes Greater Fool Theory more compelling, which begets FOMO, and sooner or later everyone is frantically buying coins to try and time the top of the market.

(An interesting contrast: Apparently search interest in stocks goes up when they’re crashing. According to one commentator, that suggests “stocks are driven by fear and crypto by greed.”)

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

This is where the real hitch comes: At least based on the last rally, bitcoin search interest isn’t useful for figuring out when the frenzied tide will suddenly go out. In December of 2017, the level of searches for “bitcoin” peaked five days after what turned out to be the all-time high (so far). So at the moment it mattered most, search interest was very much a lagging indicator.

We are not yet clearly in a bull market for bitcoin or crypto—the rally is still too young to quite earn that title. We are also still far from mainstream adoption of any crypto asset, including bitcoin, so speculation will drive any price rise in the near term. The insane logic of internet hype will probably mean explosive price growth over seemingly absurd spans of time, making it very tempting to try and catch the rocket. But as so many people learned the hard way last time around, the collapse can come just as fast, and there’s no easy way to know when the music will stop.