In its fourth-quarter 2018 earnings report released today, UMC posted a decrease in revenue of 9.8 percent compared to the previous quarter, leading to a foundry operating loss of 1.3 percent.

According to a statement issued with the report, for 2019, its prospects are not looking much better—and the downturn in crypto markets is partly to blame.

“Looking into the first quarter of 2019, we anticipate further deceleration in customers’ wafer demand, due to a softer than expected outlook in entry-level and mid-end smartphones as well as falling crypto currency valuations,” said UMC co-president Jason Wang.

The downturn in cryptocurrency price affects UMC because it manufactures semiconductor chips that are used in mining ASICs made by Bitfury. While mining-hardware companies like Bitmain, Bitfury, and others design and sell the hardware, the basic components are fabricated by chip foundries like UMC, or its main competitor, Taiwan Semiconductor Manufacturing Company (TSMC).

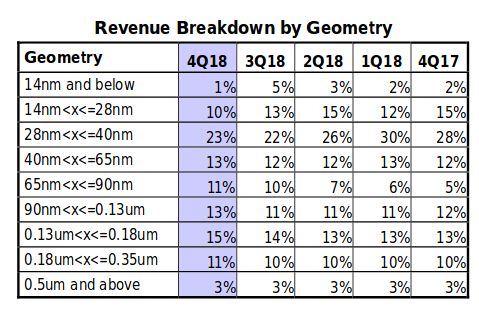

Bitfury’s latest ASIC chip, the Bitfury Clarke, uses UMC’s 14nm semiconductors and was released in September 2018. Revenue figures from UMC’s 2018 Q4 report show that the 14nm product made up 5 percent of revenue in Q3, falling to only 1 percent of revenue in Q4.

The news from UMC comes just one day after GPU manufacture Nvidia cut its fourth-quarter projections by $500 million, also citing the lack of demand from cryptocurrency miners. While cryptocurrency can be mined with gaming graphics cards when markets are high, with prices low, only the most specialized ASICs can turn a profit on the large amount of power consumed by the chips.

UMC’s announcement comes on what was already a bad day for cryptocurrency markets, as bitcoin hit its lowest price in a month Tuesday morning.