Finance is having an open source moment. From server software to car hardware, many industries have adopted collaborative innovation. Now it’s the turn of systems that send money and store wealth. We’re seeing the birth of a decentralized finance (DeFi), or Open Finance—a movement built on open, decentralized networks and shared protocols.

The current financial system fails to reach millions of people worldwide and allows central authorities to financially censor their citizens. Even in developed markets, where financial services maintain high levels of privacy and security of consumer data, there is an opportunity to provide more choices to consumers while eliminating rent-seeking intermediaries.

How do DeFi products improve on the legacy financial system? They are permissionless, giving anyone with an internet connection access, which can boost financial inclusion. They are resistant to censorship, so no third-party can interfere or reverse a transaction. They can reduce counterparty risk, as there’s no need to trust a centralized third-party to custody funds or validate transactions. They work on smart contracts that automate transactions, reducing costs on all sides. And—perhaps most interesting of all—they are composable. Unlike today’s financial products, which are essentially closed off systems owned by a single service provider, open finance products are designed to be combined.

Related: MakerDAO CEO Explains How Dai’s Soft Peg to $1 “Became Really Soft”

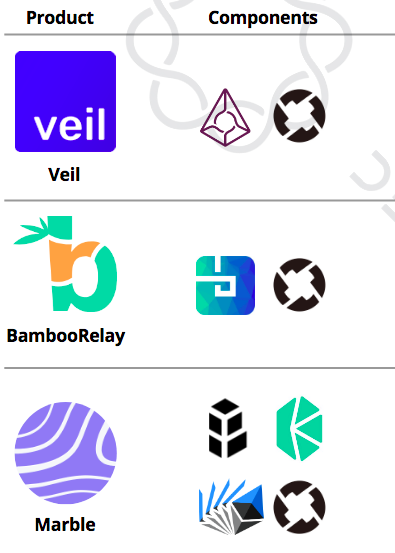

Delphi Digital—where I’m a member of the research team—recently released a report scanning the landscape of DeFi projects. The nascent industry ranges from decentralized exchanges and lending & borrowing platforms to derivatives and prediction markets. My favorite aspect is the ability for projects to leverage the work of other open finance protocols to create new, exciting products.

For example, Veil is a peer-to-peer prediction market built on top of Augur and 0x protocols. Veil offers a trading platform for instant settlement, with low 1 percent fees. It takes on the risk that an event outcome could change while a prediction market contract is being finalized. It utilizes 0x for faster trading by moving order creation and cancellation off-chain. Veil’s UX is also much easier to use over Augur itself.

Marble aims to be an open-source bank that provides funding to provably fair, low-risk protocols requiring a lender. The first offering is Flash Lending, which allows users to borrow ETH and ERC-20 tokens to take advantage of DEX arbitrage opportunities on exchanges such as Bancor, Kyber, 0x, and EtherDelta. Flash Lending allows a trader to borrow more Marble, buy a token on one DEX, sell the token on another DEX at a higher price, repay the bank, and earn a profit in a single atomic transaction. Flash Lending is in beta and has a contract deployed on the Ethereum mainnet, however, usage has been minimal.

The open source nature of decentralized finance will allow developers to see what works and what doesn't easily, while also being able to leverage tools other teams have built.

These are just a few examples of the infrastructure being built to support decentralized finance applications. Projects like MakerDAO and Compound are building decentralized lending and borrowing platforms, with over 2 percent of ETH’s supply locked up in Maker’s CDPs. Augur’s decentralized prediction markets have garnered attention in recent months as users get comfortable wagering on anything from midterm election outcomes to BTC’s year-end price.

Despite the seemingly endless potential of this growing sector, it is important to recognize the risks and concerns behind the DeFi movement. Links to physical or traditional assets are non-existent currently, limiting the product-market fit of some of these projects. Decentralized exchange can struggle with low liquidity. Many on-chain scaling solutions are still under development, capping transaction throughput. This is on top of the regulatory risk this sector faces.

Winning in this market won’t be easy. The entrepreneurs we spoke to were optimistic about the future but under no illusions about the size of the challenge. “The main roadblock preventing DeFi proliferation is the lack of access to real world assets as collateral in DeFi applications, which would allow them to scale beyond their current boundaries,” says Rune Christensen, CEO of MakerDAO. “I think the first few solutions for regulated assets compatible with DeFi will come out in 2019, but only really gain momentum in 2020 and beyond.”

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

Tim Ogilvie, CEO of Staked, which helps institutional investors stake or lend their holdings in proof-of-stake cryptocurrencies, told us: the “biggest roadblock is that the centralized alternatives are often as good as the decentralized ones.”

By moving to an open source framework for innovation, these companies should be able to move more quickly than traditional financial players and build out today’s DeFi infrastructure rapidly. We’re in the early-early stages of this trend. That being said, we believe decentralized finance is a more viable near-term use case for crypto than many of the other ideas that had ICOs in 2017. Eventually, open finance could produce better products for end-consumers. Unlike fintech, which is focused around building mostly proprietary software, the open source nature of decentralized finance will allow developers to see what works and what doesn’t easily, while also being able to leverage tools other teams have built.

Anil Lulla is a cofounder of Delphi Digital, the New York research firm dedicated to digital assets. Sign up today to get access to Delphi’s Insights product for just $25/month or $250 for an annual subscription.