When it was first announced, the KODAKOne blockchain project was greeted with skepticism—to put it very, very mildly. Unveiled at the height of the crypto-bubble in January of 2018, the proposal to use blockchain to manage image copyright on the web looked to many (including this writer) like a crass bid to leverage the frothy market for ICOs into buzz (and a stock bump) for the onetime titan of analog photography. It earned Kodak derisive mentions alongside shady operations like Long Blockchain and Riot Blockchain.

A year later, it might be time for cynics like me to eat a little crow: KODAKOne announced today that it has generated more than $1 million in licensing claims for photographic rights during a beta test of part of its platform. In an exclusive interview, KODAKOne co-founder Cam Chell described to BREAKER how the project hopes to meld AI, cryptocurrency payments, and on-chain metadata to open up a potentially major new source of income for professional photographers, and maybe even amateurs. It’s a compelling case, though KODAKOne acknowledges it’s still early days.

KODAKOne is, crucially, not a project of the Eastman Kodak company. Instead, the Kodak name was licensed from Eastman Kodak by RYDE Holding (formerly Wenn Digital), and is being built in collaboration between RYDE and ICOx Innovations, where Chell is chairman.

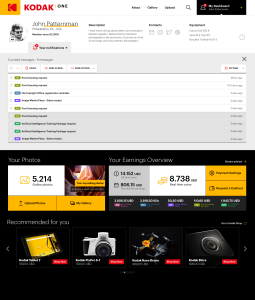

As Chell describes it, the rise of digital has been hard on professional photographers—once one website pays to use it, an image can easily be copied without permission or payment all across the web. KODAKOne’s Post Licensing Portal, or PLP, which launched in beta in October, uses a web crawler and AI image recognition to check web images against a database of managed images. Once an unlicensed use is detected, KODAKOne sends an automated notification asking for license payment, which KODAKOne describes as “positive and user-friendly” for infringers. Once the KODAKOne system is complete, those payments can be made using either legacy fiat systems, or using the KodakCoin payment system to be built into the platform, potentially increasing the level of granularity and automation.

“The reason that more licensing [revenue] isn’t captured is because it’s just heavy lifting,” says Chell. “Even in that professional market, you’re really [collecting licensing fees from] 20 percent of the market at best. The other 80 percent of that market is still not monetized . . . because of the cost of human intervention, as opposed to being able to have this on the blockchain and use smart contracts.” KODAKOne will take a significant fee from from those new revenues: of the more than $1 million in licensing claims generated during the PLP beta, Chem says KODAKOne would keep around $400,000.

Images tracked during KODAKOne’s beta included those from partner Blaublut Edition, a high-end beauty, fashion, and lifestyle photo licensor. According to Chell, high-end photos are often modified for re-use using photo editing software, a deception Chell says the KODAKOne PLP can see through.

Though they’re beta-testing with professionals, Chell says the team has seen evidence that “over the course of the next 18-24 months [KODAKOne will expand] into the prosumer and consumer market as well,” making it easier for amateurs to control and leverage their own photos. A taste of this was unveiled in June, when RYDE announced a partnership with several NHL and NBA-affiliated arenas. Fans in those arenas will be able to register ownership of photos they take to the KODAKOne blockchain, using a dedicated mobile app. They’ll be incentivized with KodakCoin tokens redeemable for merchandise in the venues. Venue operators, in turn, will have increased access to fan-created content, which is often posted to social media on terms that can strip photographers of their intellectual property rights.

That preliminary agreement shows that KodakCoin is distinct from the so-called ‘utility tokens’ that fueled the ICO boom and have recently faced some skepticism. Chell describes it as partly a consumer-targeted loyalty program, as well as low-cost payment rails for photographers who sign up (though they can also choose to be paid in fiat).

Chell clearly wants to dissociate KodakCoin from the speculative mania around ICOs (which KODAKOne has already bypassed in favor of a carefully-planned SAFT, or Simple Agreement for Future Tokens, conducted in May). For one, he suggests that corporate ‘loyalty tokens’ like KodakCoin will not initially have fluctuating fiat value.

“Our prediction is that most of these coins are going to come out pegged to a fiat. But as coins become more successful, they will move into a floating model, because there’s just greater leverage for the corporate treasury to be able to work with. Just as [traditional currency] was at one time pegged to gold, and eventually came off that gold standard,” he says.

The technology behind KODAKOne appears to be sophisticated. KodakCoin is currently planned to be an ERC-20 token using components of Stellar as middleware. The freestanding KODAKOne blockchain, where IP management will be handled, will use a combination of Ethereum, Stellar, and Hyperledger.

The technology behind KODAKOne appears to be sophisticated. KodakCoin is currently planned to be an ERC-20 token using components of Stellar as middleware. The freestanding KODAKOne blockchain, where IP management will be handled, will use a combination of Ethereum, Stellar, and Hyperledger.

When it comes to the backlash that greeted last year’s KODAKOne announcement, Chell says Eastman Kodak and its CEO, Jeff Clarke, have “been involved every step of the way, and they have been nothing but supportive. They believe digital rights management is a huge part of the future.”

“Nobody had any expectation of the size of the press that was going to happen around Kodak doing a blockchain,” Chell adds. “It was never intended that we were doing a coin to raise $150 million to fund a startup. We certainly got thrown into that, because that’s what the market was looking for, and that’s what they thought ICOs were about. Out of the gate, we’ve always said, those were securities, and we’re a payment mechanism.”

“Hopefully what we’re able to demonstrate is that one year later, all these ICOs who knew everything about everything . . . where are they today? We’re here today, and we’ve got a project and we’re generating revenue. And we’re just getting started.”