SEC Commissioner Hester Peirce became a meme last year after dissenting on an agency decision to reject a new bitcoin exchange-traded fund (ETF). The industry immediately saw one of its own and bestowed an affectionate nickname: “Crypto Mom.” Peirce, a former lawyer, is seen as the most crypto-friendly of the SEC’s five commissioners—someone who will fight crypto’s battle for mainstream acceptance and champion its fundamentally anti-government ethos.

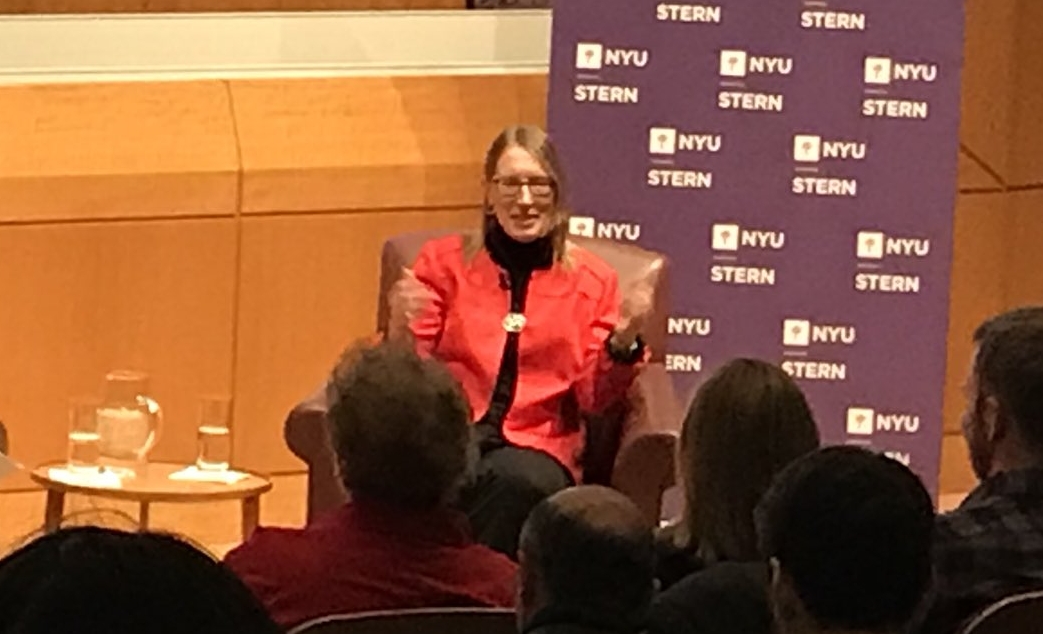

Last night, Peirce sat down with journalist Laura Shin for a “fireside chat” at NYU (although, of course, there was no fire). She talked about working with the grain of innovation, even if innovation occasionally hurts investors, and how she wants to bring the SEC kicking and screaming into the modern world. (The SEC was created in the mid-1930s and many of the statutes it enforces date from those times.) She shed light on the (very complicated) decision-making process within the SEC, defined what is and isn’t a security, and talked about how a regulator might oversee a decentralized entity where nobody is in control. Here are some takeaways.

The SEC hasn’t done a good job.

Peirce repeatedly criticized her employer for not being a better partner to crypto entrepreneurs and investors. “We’ve not been great at innovation,” she said. She described the SEC as “conservative” and “running the other way” from the crypto boom. She said the agency could have provided better guidance to projects during the 2017 ICO run-up (it issued general principles late in December of that year but these were widely seen as vague and after-the-fact). Now, the SEC has apparently gone to the opposite extreme. Many utility tokens—which are not promises on the underlying value of the crypto enterprise—are being swept up in securities laws, and effectively hounded from U.S. shores. “I want to see a bit more action here,” Peirce said.

"I don't need to regulate watches."

The SEC shouldn’t regulate watches.

One test the SEC uses to decide whether a token is a security is whether investors believe they can make money from the project. But how to get inside the head of an investor at the moment she clicks a buy-button on an exchange screen? “I might not come to the same conclusion as some of my colleagues might, because often you’re looking at what was in the purchaser’s head when she bought a token,” Peirce said. There are lots of things people buy that appreciate in value over time—should they all be regulated by the SEC? “If we’re not careful, we might expand the jurisdiction to everything people might buy,” Peirce said. “I don’t need to regulate watches.”

It’s not the SEC’s role to protect investors from themselves.

It’s not the SEC’s role to protect investors from themselves.

Peirce is a hands-off sort of mom, preferring her offspring to make mistakes and learn, rather than proscribing lessons ahead of time. The decision to reject the Winklevoss ETF (which gave rise to her dissent in July 2018) “had the whiff of merit regulation,” she said. In other words, it was rejected because the SEC thought the product was materially bad for investors, Peirce said, not because it fell foul of the SEC’s mandate to promote well-functioning markets. The ETF was rejected because the SEC lacks tools to understand underlying bitcoin markets that dictate the ETF’s value, not because, she said, the product itself was bad.

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

Congressional push or new legislation?

Congress is currently considering the Token Taxonomy Act, which effectively exempts utility tokens from securities regulation. The bill has cross-party support and has received lobbying from Silicon Valley, but is seen currently as a long-shot for passage. Peirce said Congress doesn’t necessarily need new laws if it wants the SEC to be more supportive to the crypto industry. But, given the SEC’s inherent inertia, new legislation would probably have a more permanent effect.

"We don’t want to outlaw writing code.”

Decentralized exchanges are a coming issue.

Automated crypto exchanges could pose unique challenges for regulators, who are used to framing blame on actual humans (DEXs include Idex or 0x, though Peirce didn’t name any projects). She doesn’t support making coders of open protocols liable for how they’re used (some legal scholars, like Angela Walch, have discussed fiduciary responsibilities for coders recently). “I don’t want someone who’s writing code to have to worry that she’s going to get blamed down the road for what someone else did with her code. That’s an area that I’m particularly concerned about,” Peirce said. “We don’t want to outlaw writing code.”