In a bombshell filing late Thursday, April 25, the New York Attorney General alleges that the crypto exchange Bitfinex conspired with Tether, a closely related entity that issues the purportedly dollar-backed cryptocurrency Tether, to conceal huge losses to Bitfinex’s fiat cash reserves. According to the filing, more than $850 million of Bitfinex funds were seized or lost by Crypto Capital, a payment processor, causing serious problems in customer withdrawals in late 2018. Attempts were allegedly made to restore liquidity through the secret transfer of large amounts of funds between Tether and Bitfinex beginning around November of 2018.

The filing caused a nearly immediate five percent dip in the value of bitcoin, with even sharper drops for some other cryptocurrencies. That points to serious market anxiety over the possibility that Tether, which has an important role in cryptocurrency markets, would lose its peg to the U.S. dollar. But the filing doesn’t directly support critics’ most serious allegations about Tether issuance. In fact, it seems to highlight a systemic risk few have paid close attention to: Crypto Capital itself, which forms a common thread between Bitfinex and competing exchanges including Coinapult and QuadrigaCX, all of which have faced serious banking problems.

The alleged transfers between Tether and Bitfinex were a complicated web of lines of credit and swaps among multiple accounts around the world, all facilitated by the fact that Bitfinex and Tether have substantial overlap in leadership and ownership. In fact, according to yesterday’s filing, the same two individuals authorized transactions for both Bitfinex and Tether. Tether seemingly had little to gain from the risk it shouldered by bailing out Bitfinex, leading the New York AG to raise concerns about conflicts of interest. The transfers were never reported to Bitfinex corporate investors, Tether token holders, or others put at risk by the companies.

While Tether and Bitfinex are the target of the filing, it’s Crypto Capital that’s at the center of the broader story.

The New York Attorney General claims jurisdiction in the matter on the basis that New York residents have continued to be able to use Bitfinex and Tether, despite restrictions against Bitfinex operating in the state. The AG is seeking a raft of documents, including bank records and a list of all U.S. customers, to determine New York residents’ exposure “to ongoing fraud being carried out by Bitfinex and Tether.”

The new filing sheds light on a few matters that have fueled ongoing skepticism around Tether. The token has more than $2.8 billion in circulating volume, making it a top 10 cryptocurrency, and has become a key tool for cryptocurrency trading and speculation. Since at least 2017, critics have questioned Tether’s claims that Tether tokens are fully backed by U.S. dollars held by banks. In March, Tether changed its terms of service to read that Tethers are backed by a mix of currency and “other assets.” This appears to have been a response to the late 2018 events described in the filing.

The New York AG isn’t saying much about Tether issuance practices—for instance, claims that the “printing” of unbacked Tether actually caused the crypto bubble of 2017. The filings do, however, provide compelling evidence that the leadership of Bitfinex and Tether are willing to engage in financial chicanery to conceal problems.

In response, Tether states that the New York Attorney General’s filings were “written in bad faith and are riddled with false assertions.” Specifically, it claims that $850 million of funds once held by payment processor Crypto Capital are not “lost,” but “have been, in fact, seized and safeguarded.” (The fact that Tether is commenting on funds nominally owed to Bitfinex would seem to highlight, rather than downplay, the troubling nature of the two entities’ relationship.)

And that, it seems, is the real crux of the matter—while Tether and Bitfinex are the target of the filing, it’s Crypto Capital that’s at the center of the broader story. (Crypto Capital was not immediately available for comment.) According to its website, Crypto Capital provides banking and payment services for exchanges including QuadrigaCX, Coinapult, and Cex.io, though references to Bitfinex have apparently been removed. Crypto Capital was founded in 2013 in Panama, though it currently lists its headquarters as Zug, Switzerland.

Get the BREAKERMAG newsletter, a twice-weekly roundup of blockchain business and culture.

There is a common thread between several of those Crypto Capital clients. QuadrigaCX had Bitfinex-like withdrawal problems throughout fall and winter of 2018, some of which it publicly blamed on Crypto Capital. QuadrigaCX declared bankruptcy after its CEO’s apparent death late last year. Its unwinding has been a source of endless investigation, debate, and speculation.

Coinapult is a much lower-profile exchange, but it announced in December of 2018 that it was “experiencing issues” and that “withdrawals may take longer than usual.” The company has not made a public announcement since, and may no longer be operational. Cex.io, in communications reported by a customer in mid-2018, described “significant difficulties with translations in U.S. dollars due to unsatisfactory provision of payment provider services, which violated both its terms of cooperation and its guarantees.”

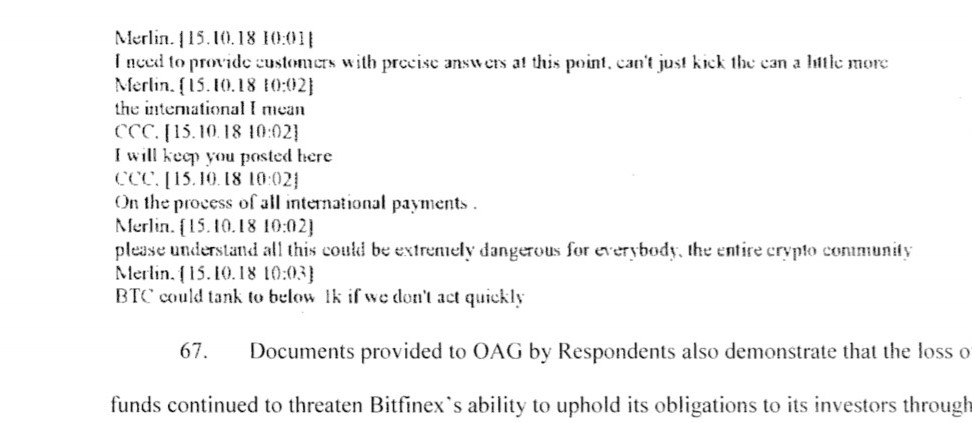

Then, of course, there’s Bitfinex and Tether. One of the most riveting parts of yesterday’s New York filing is a set of chat logs showing a senior Bitfinex executive (going by “Merlin” in the chats) begging a Crypto Capital representative, with increasing urgency, to release Bitfinex funds. The logs begin in August of 2018 and stretch through late November, with the Bitfinex exec repeatedly describing customer withdrawal requests going unfulfilled for long periods of time. In mid-October 2018, “Merlin” echoes the concerns of outside critics, speculating that “BTC could tank to below 1k if we don’t act quickly.” A few days later, “Merlin” writes that “too much money is trapped with you [Crypto Capital] and we are currently walking on a very thin crust of ice.”

Why did Crypto Capital fail or refuse to release funds owed to Bitfinex and, apparently, other exchanges it was servicing? According to the NYAG’s filing, Crypto Capital claimed to Bitfinex that as much as $851 million had been seized by government authorities in Portugal, Poland, and the United States. The filing states, however, that Bitfinex didn’t believe those claims from Crypto Capital, and instead “grew concerned that Crypto Capital’s principals may be engaged in a fraud.”

Is it possible that problems at QuadrigaCX, Coinapult, Cex.io, and Bitfinex can all be attributed to malfeasance by Crypto Capital? This would amount to perhaps the most brazen cryptocurrency fraud of all time: A possible “exit scam” perpetuated, not by a shady ICO or exchange, but by a company providing banking services to several exchanges.

There is, however, significant evidence of government seizure of Bitfinex funds managed by Crypto Capital. Polish media reported in April of 2018 that roughly USD $340 million was seized from two accounts, at least one of them linked to Bitfinex and Crypto Capital.

A few particularly canny observers have had their eyes on Crypto Capital for some time. Analyst James Edwards described Crypto Capital as “Crypto’s Black Swan” earlier this year, pointing to the systemic risk it could represent. In late 2017, early Ethereum developer Mathias Grønnebæk excavated what few facts were available about Crypto Capital’s history, leadership, and links to other entities.

Yesterday’s Attorney General filing requests documents that may, eventually, shed light on some elements of these complex proceedings. BREAKERMAG will also continue digging. But what we already know suggests the real story may have been missed for months, if not years: Instead of multiple exchanges with shoddy practices, a single entity may deserve much of the blame for crypto’s shaky financial footing.