In a bold Twitter thread Thursday afternoon, Coinbase CEO Brian Armstrong cited evidence that the collapsed Canadian exchange QuadrigaCX had been trading with customer funds before its collapse, lost money in the 2018 bear market, then used the death of its founder to cover up that mismanagement. Armstrong’s theory, though surprisingly speculative coming from such a major figure, is just the latest rebuttal of claims by QuadrigaCX that it was forced to close because the death of its founder left it locked out of wallets holding tens of millions of dollars worth of its customers’ cryptocurrency.

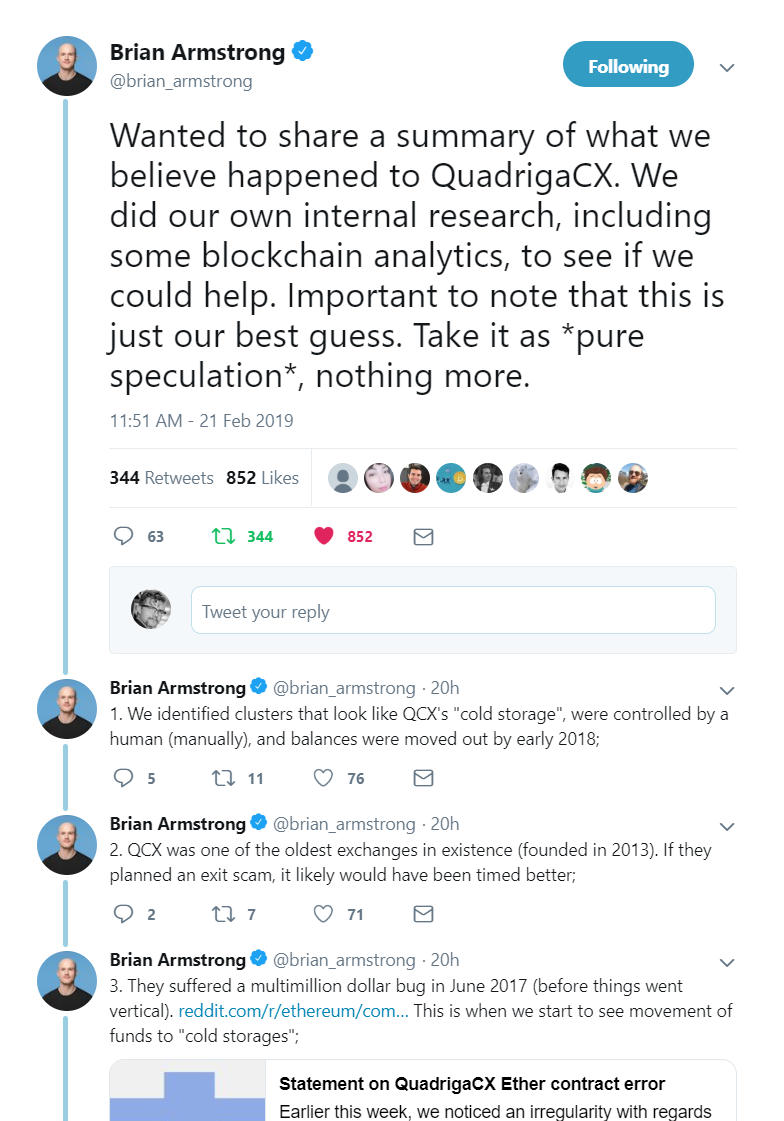

Armstrong began by emphasizing that his statements were both “based on internal research” and “just our best guess,” a mix of hard evidence and logical but unconfirmed inference.

Wanted to share a summary of what we believe happened to QuadrigaCX. We did our own internal research, including some blockchain analytics, to see if we could help. Important to note that this is just our best guess. Take it as *pure speculation*, nothing more.

— Brian Armstrong (@brian_armstrong) February 21, 2019

Armstrong does cite some new hard evidence. Coinbase’s internal research found “clusters that look like QCX’s ‘cold storage,” but those funds were “moved out by early 2018.” Other researchers have been unable to find evidence of the exchange’s cold storage—wallets where customer funds are normally held long-term in an especially secure manner.

1. We identified clusters that look like QCX's "cold storage", were controlled by a human (manually), and balances were moved out by early 2018;

— Brian Armstrong (@brian_armstrong) February 21, 2019

This movement of apparent customer funds, according to Armstrong, began soon after Quadriga experienced a bug that locked up roughly 67,000 customer ETH (about $14.8 million at the time) in June 2017.

3. They suffered a multimillion dollar bug in June 2017 (before things went vertical). https://t.co/SxBLcJgaiP This is when we start to see movement of funds to "cold storages";

— Brian Armstrong (@brian_armstrong) February 21, 2019

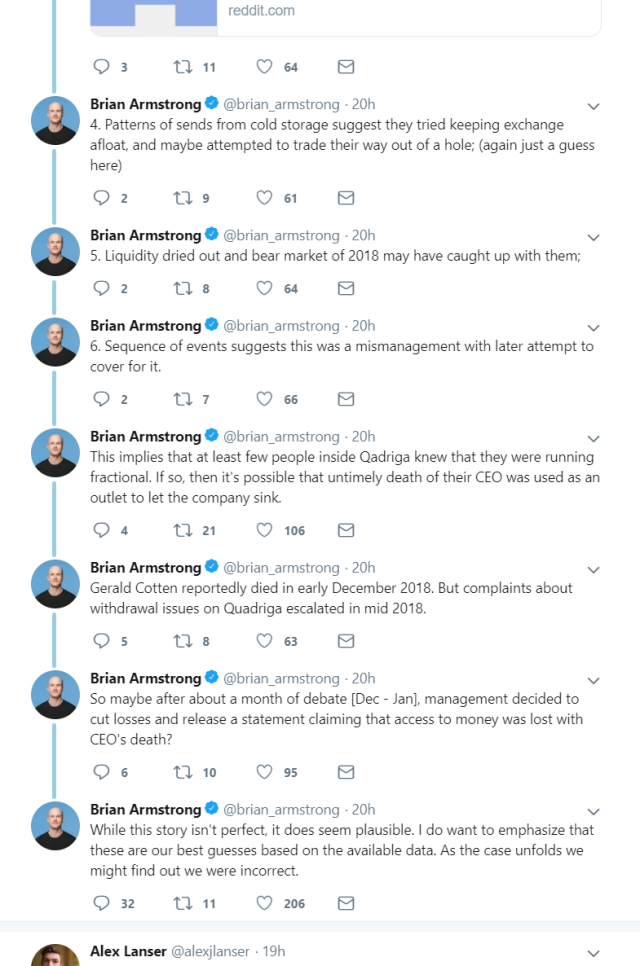

Armstrong then leaps into the realm of, by his own admission, speculation. “Patterns of sends from cold storage,” he writes, “suggest they tried keeping exchange afloat, and maybe attempted to trade their way out of a hole; (again just a guess here).” That squares with earlier findings by MyCrypto CEO Taylor Monahan that Quadriga wallets were sending funds to other exchanges, and to ShapeShift, in defiance of any logic consistent with a well-run exchange.

While trading with customer funds may have actually allowed them to recover some losses through the massive bubble of late 2017, Armstrong says that ultimately the “bear market of 2018 may have caught up with them.” He believes this may have amounted to “mismanagement with [a] later attempt to cover for it.”

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

Finally, Armstrong spins a plausible but entirely conjectural scenario of the events around Gerald Cotten’s (now seemingly verified) death in December 2018. (We’ve combined several tweets into a readable paragraph):

“This implies that at least [a] few people inside Quadriga knew that they were running fractional. If so, then it’s possible that [the] untimely death of their CEO was used as an outlet to let the company sink. Gerald Cotten reportedly died in early December 2018. But complaints about withdrawal issues on Quadriga escalated in mid 2018. So maybe after about a month of debate (Dec-Jan), management decided to cut losses and release a statement claiming that access to money was lost with CEO’s death?”

Related: 11 Fishy Things About the QuadrigaCX Mystery

It is in many ways shocking that the head of the largest U.S. crypto exchange would engage in such public theorizing. Of course, it’s good for his business to spread stories about apparent instability inside other exchanges, as Coinbase looks to further consolidate market share and expand its global footprint. But the speculation would also seem to expose him to legal action (for libel perhaps) from remaining Quadriga leadership.

Armstrong did emphasize throughout where he was spitballing, including in one final tweet: “While this story isn’t perfect, it does seem plausible. I do want to emphasize that these are our best guesses based on the available data. As the case unfolds we might find out we are incorrect.”

Despite such hedging, we are appending screenshots of Armstrong’s tweets below, because, frankly, they may not stay up for long.