Bitcoin was created in reaction to the financial crisis to circumvent centralized control of financial systems and money itself. Now, in an ironic twist, it looks like centralized banks are embracing the technology designed to kill them. More than 40 central banks worldwide are exploring or experimenting with central bank digital currencies (CBDCs), according to a recent report from the World Economic Forum. Beginning in 2014 with the Bank of England, there are now 60 research papers and numerous pilots exploring CBDC, with central banks also examining decentralized ledger technology for at least 10 different use cases.

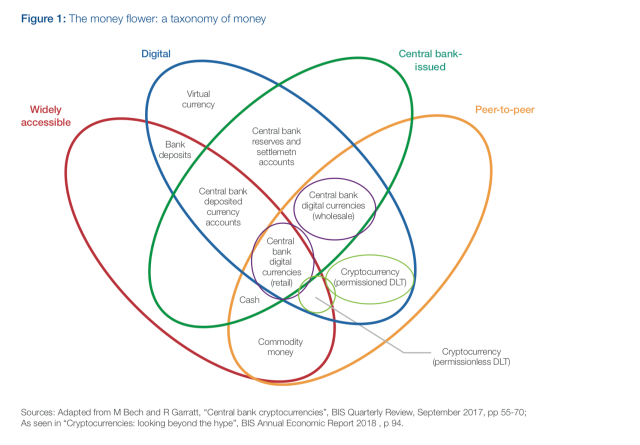

According to the report, many of the pilots feature the central bank issuing digital tokens on a distributed ledger that represents, and can be redeemed for, central bank reserves in the domestic currency. People with access to these permissioned blockchains then use the CBDC to make digital transfers that are validated on these blockchains. (A quick refresher: Bitcoin and Ethereum are on permissionless blockchains, allowing anyone to participate and have full transaction transparency.)

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

One of the central banks cited in the report is the Bank of Lithuania, which is planning to issue a Digital Collector Coin to test blockchain on a small scale, while also sponsoring a blockchain sandbox called LBChain. Another is the Eastern Caribbean Central Bank, which is looking at the long-term viability of a DLT-based Eastern Caribbean currency to “pursue multiple goals such as advancing economic growth, payments system resilience and financial inclusion.” Meanwhile, the Swedish central bank (Sveriges Riksbank) is exploring a blockchain-based “e-krona” to serve as a digital form of bank-issued money, as physical cash usage continues to decline in Switzerland. However, Sveriges Riksbank has not yet determined whether it will use DLT for this project.

The most extensive example the report identifies is the Bank of Cambodia, which seems to be jumping headfirst into CBDC and DLT. It will be implementing blockchain in the second half of 2019 for use by consumers and commercial banks in its national payments system. The goal is to achieve better financial inclusion, as well as system efficiency in the banking industry. A large portion of Cambodia’s underbanked citizens use cash and various mobile-payment apps, so implementing a blockchain-based payment service is, according to the report, “designed to operate both with private mobile payment applications and commercial bank accounts, facilitating interoperable retail payments between citizens and businesses and encouraging citizens to adopt bank accounts, which support savings and financial stability.”

The coming years will give us a better indicator of who is likely to follow through on these projects and who will be forever “exploring.”

The report also raises the risks that must be addressed before moving full-speed ahead with these kinds of projects. The potential for financial exclusion is under-discussed in current research on CBDC, the report says. Any policy implementation must include outreach to underbanked people, so that they can participate in any new digital currency plans. Obstacles, particularly for countries with underdeveloped financial systems, include the usability of the products, access to them, and insufficient identity documentation. Given how wealth inequality has swept the world, it’s not hard to imagine policy pitfalls when it comes to ensuring underbanked people’s participation.

Another risk the report identifies is that if people come to see CBDC as more secure and viable than a commercial bank, they’ll remove their money from these institutions. That could cause commercial banks to be more volatile and to negatively impact their lending activity.

Even so, some experts believe we could see CBDC create alternative systems that exist outside of dominant models, and counterbalance private sector payment tools that dominate many countries. In many ways, these systems would make sense where traditional, unreliable payment methods can be displaced relatively easily. The coming years will give us a better indicator of who is likely to follow through on these projects and who will be forever “exploring,” but these use cases continue to show both the ways that blockchain and cryptocurrencies have altered the parameters of our financial world—and that there is interest in doing so further.