Blockchain—the term, the trend, or both—may be losing favor in the business world.

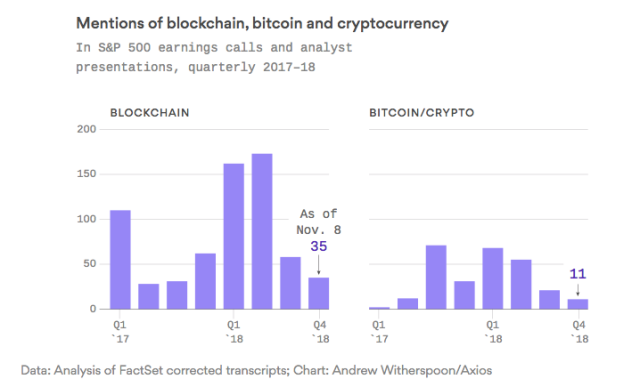

According to a recent Axios report, the mention of the word in S&P 500 companies’ earnings calls and presentations to analysts and investors has dropped dramatically over the course of this year. Executives went from mentioning “blockchain” a total of 173 times in earnings calls and presentations conducted in Q2 to just 35 times in Q4. Granted, the quarter is not over yet, but Q3 yielded just over 50 “blockchain” mentions—still a steep decrease from earlier this year.

Image from Axios

“Bitcoin” and “crypto” references have also dropped since the start of 2018, but not as dramatically. During the first quarter, S&P 500 executives used one or the other a total of 68 times during these calls, a number that dropped to 11 this quarter. “Cryptocurrency” has long sounded shadier than “blockchain,” seeing perhaps as no one has ever purchased drugs on the dark web by paying in “blockchain.”

Axios analyzed calls and presentations from all S&P 500 companies, author Courtenay Brown told BREAKER. The list of these companies includes heavy hitters like Aetna, Amazon, Facebook, Halliburton, Twitter, and many others. Not all of them, of course, mentioned “blockchain.” Brown flagged a handful, she told BREAKER, such as BlackRock, JP Morgan, Verizon, Mastercard, Nasdaq, IBM, Red Hat, Visa, Goldman Sachs, and Starbucks.

IBM, the analysis found, accounted for 70 of the 100-plus “blockchain” mentions in the first quarter of 2017—not surprising for a company that’s in the news nearly every other day for its various blockchain-related projects. With such a significant chunk of “blockchain” mentions attributed to IBM, it means very few of the remaining 499 companies mentioned blockchain at all.

Of the few that did, some was clearly just for the hype. DXC Technology, Axios points out, brought up “blockchain” five times in a May 2018 earnings call but hasn’t breathed a word about distributed ledger technology in a call since.

Speaking of distributed-ledger technology, Axios’s study didn’t seem to check for mentions of DLT, which a Forrester report from last week noted has started to replace “blockchain” in company descriptions.

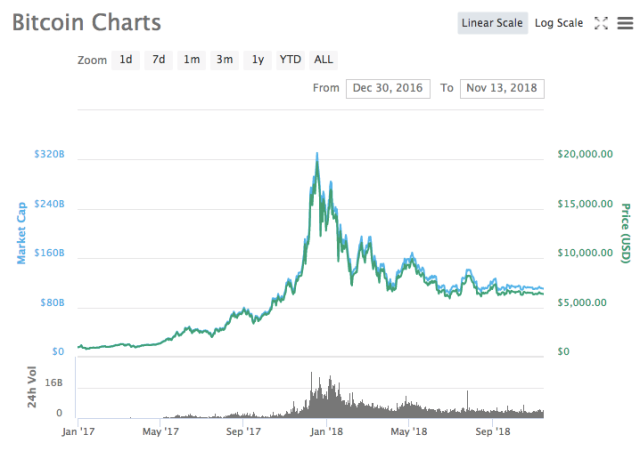

Unsurprisingly, the bar graph of “bitcoin” and “cryptocurrency” mentions by heavyweight companies tracks loosely with the line graph of bitcoin’s value in U.S. dollars. As bitcoin’s price made its way up in 2017, the word buzzed around earnings calls and investor presentations. It dropped a bit after the initial excitement later in 2017 and picked back up again at the start of this year. Since then, mentions have steadily decreased, like bitcoin’s value.

Bitcoin prices between December 30, 2016 and November 13, 2018 (from Coinmarketcap)

The “blockchain” use graph looks similar but not identical. First of all, use cases of the term are consistently more frequent than “bitcoin” and “crypto.” Additionally, “blockchain” seemed to pick up steam well before the two currency-related terms did in 2017—but this was likely due to IBM’s bullish stance back in 2017’s first quarter; IBM hopped on the blockchain bandwagon years ago.

So yes, people are getting tired of hearing that every company is “pivoting to blockchain.” But just because executives aren’t talking about it as fervently as they used to, doesn’t mean companies aren’t still doing it. In fact, tech job recruiter Hired found that postings for blockchain-capable candidates increased by 400 percent since it first listed the skill as a “sub-role” during Q4 of 2017. If you’re looking for work as a blockchain engineer, there’s certainly no shortage of opportunities at IBM, and plenty of mentions of the word “blockchain” on IBM’s press page.

This article has been updated to include commentary from Axios’s Courtenay Brown.