Now that the dust and the beer have settled, we can all agree that Super Bowl LIII was a snoozefest. After three quarters of play without a touchdown, the Patriots’ victory was well-earned but less than inspiring, and one of the most entertaining parts of the coverage was watching CBS reporter Tracy Wolfson bravely weathering a huge media scrum to interview Tom Brady.

Thankfully, betting on a game doesn’t require an exciting outcome. On Feb 2, a Medium post from ConsenSys reported that the Augur prediction market favored a Patriots win by 55 to 45 percent; not remarkable in itself, as bookmakers and sports analysts were already giving similar odds. But since ConsenSys led with the claim that Augur’s platform “will overtake Vegas for sports betting,” it’s worth looking at whether the figures bear this out.

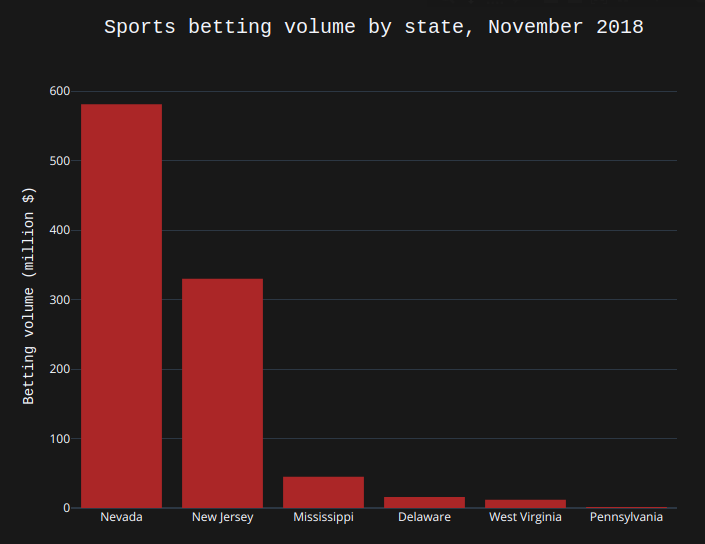

In 2018, Nevada had a record year for sports betting, taking in over $5 billion in legal bets

According to Augur statistics tracker Predict.Global, the total money at stake in all open bets on Augur is $1.5 million, slightly more than the amount of sports betting that took place in the state of Pennsylvania in November.

Although Augur operated a few separate prediction markets for the Super Bowl (since any Augur user can create a market), even the most popular of these had attracted less than $30,000 in “open interest,” the value of outstanding bets in the market.

In addition, although it might be a headline-worthy claim to say that Augur will overtake Vegas, it rests on a misapprehension.

“With most states likely to offer sports betting in the future,” the ConsenSys blog post says, “Vegas will begin to lose its monopoly of the sports betting market. Online and decentralized platforms like Gnosis and Augur will usurp centralized sports betting to become the gambling platforms of the future.”

The thing is, Augur’s closest competition isn’t so much with the legal betting of Nevada as with the illegal betting that already proliferates through online sportsbooks located offshore.

Last year the American Gaming Association estimated that illegal betting made up 97 percent of Super Bowl wagers. This year the AGA declined to comment on the volume of legal vs illegal bets, but estimated that Americans would wager $6 billion on the Super Bowl overall, with 1.8 million people betting illegally through a bookie and “millions more” using offshore online books.

Without more precise figures it’s hard to know how the total amount of money wagered is split between offline and online betting, but we’re talking billions of dollars wagered on the event through existing online channels. Augur might have a novel approach to prediction markets, but it needs to grow a long way to overtake Vegas, and even further to take market share from its online competitors.

There are some people who see this as a realistic possibility, but in the near-term future—well, I wouldn’t bet on it.