A new report on Ethereum shows what triggers ether price drops and calls into question how sustainable decentralization of the Ethereum blockchain really is.

The report, titled “Entering the Ethereum: Long-Term Value Potential and Analysis,” was created by Delphi Digital, a research and consulting firm focused on digital assets. Delphi Digital’s six-person team comes largely from traditional finance backgrounds (half have held positions at Deutsche Bank) and includes Morgan Creek Digital founder Anthony Pompliano as a board member.

Get the BREAKERMAG newsletter, a weekly roundup of blockchain business and culture.

Their report explores the past, present, and future of Ethereum—the latter honing in on the transition to Serenity (aka Ethereum 2.0)—and focuses on how people are using ETH and the network’s potential vulnerabilities as it evolves. Here are some highlights from the report:

Hard forks and price dips

The price of ether has dropped with the past five hard forks, according to Delphi Digital, at an average of 19 percent during the month following the fork. However, ether’s price dropped by less than one percent after the second most recent hard fork, Byzantium. The report chalks this up to the decrease in block rewards resulting from that fork (they went from 5 ETH to 3 ETH) and how excited everyone was about cryptocurrency around the height of the craze. Byzantium took place in October 2017, not long before the price of ETH hit its all time high. ETH prices also rose close to 30 percent in the 30 days prior to the Constantinople and St. Petersburg upgrade.

The dapp report

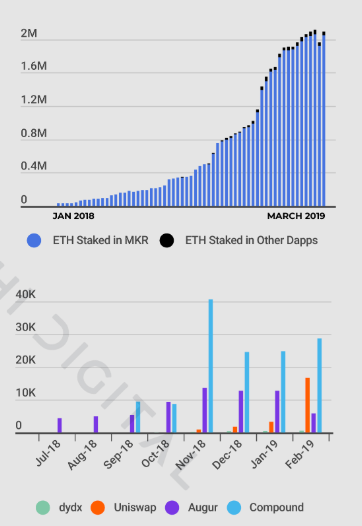

As of March 3, more than 2.3 million ETH was staked in decentralized finance apps. That’s about two percent of the total ETH supply. Most of this coin is in MakerDAO—about 2 million ETH (worth about $274 million) compared to the roughly 28,500 ETH in Compound, the second most staked app, and the 5,812 ETH in Augur, number four on the list.

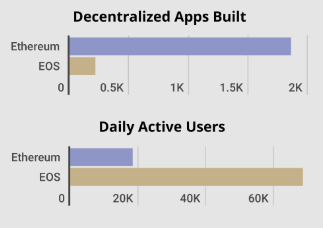

Overall, there are plenty of Ethereum-based dapps. However, not many people are using them—especially when you look at the numbers side by side with the dapps on EOS. While developers have built close to 2,000 dapps on Ethereum, compared to the few hundred built on EOS, more than 60,000 people are using EOS dapps, while less than 20,000 are using those build on Ethereum.

Overall, there are plenty of Ethereum-based dapps. However, not many people are using them—especially when you look at the numbers side by side with the dapps on EOS. While developers have built close to 2,000 dapps on Ethereum, compared to the few hundred built on EOS, more than 60,000 people are using EOS dapps, while less than 20,000 are using those build on Ethereum.

Risking decentralization

Ethereum faces a number of technical risks as it transitions to Serenity. Among the more concerning, according to Delphi Digital, is the widespread reliance of Ethereum dapps on Infura, a ConsenSys spoke that lets developers connect to Ethereum without having to run a node. Infura is basically centralized, as it’s entirely owned and operated by ConsenSys and hosted by Amazon Web Services. Infura also “accounts for 5 to 10 percent of all nodes” in the Ethereum network. With so many supposedly decentralized apps relying on these centralized services (“mesh” or not, ConsenSys is still a company with leadership, and Amazon is Amazon), it’s a legitimate fear that the network’s dependence on Infura could lead to the centralized shut down of dapps that run on it.

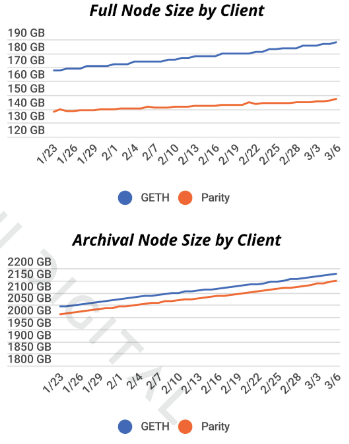

Another concern mentioned in the report is Ethereum’s growth. The size of Ethereum nodes is increasing at an significant rate, and the bigger blockchain, the more difficult it becomes to operate a node independently. This puts decentralization at risk.

Bottom right chart indicates that full GETH node size has gone up by about 12 percent over the past six weeks. (GETH is a client that runs Ethereum nodes.)

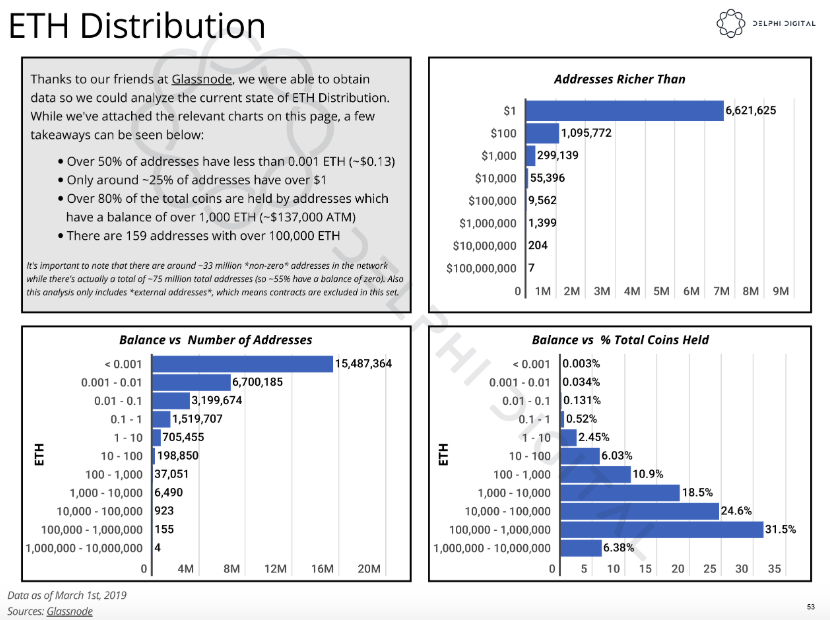

Speaking of risks to decentralization, there’s always the concern that cryptocurrencies aren’t really as distributed as people think, because a small number of wallets often hold a vast percentage of coins. This is true to an extent with ETH. As the report shows, more than 50 percent of wallet addresses hold less than 0.001 ETH (as of writing, worth about $0.14). Together, only 7,572 wallet addresses hold 80 percent of the total ETH supply. These are wallets with more than 1,000 ETH.

Where is Ethereum?

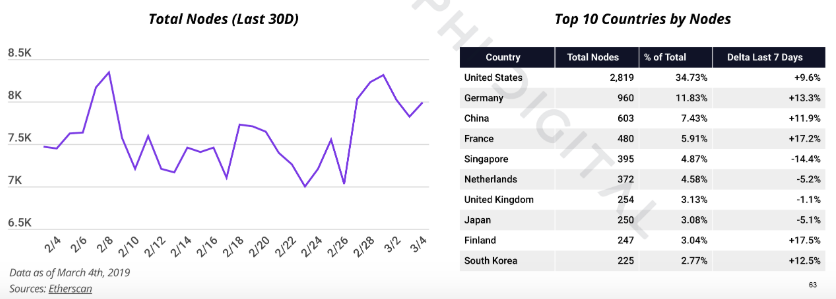

Lastly, the largest concentration of Ethereum nodes are operated in the U.S. There are 2,819 nodes running in the country, making up 34.7 percent of total nodes over the past 30 days (as of March 4). Germany comes in second, home to 11.8 percent of the total Ethereum nodes, followed by China, with 7.4 percent. Finland and South Korea are at the bottom of the top 10, with 247 and 255 nodes, respectively.