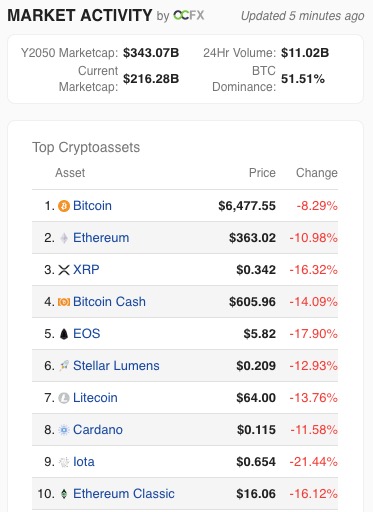

The cryptocurrency market lost 20 percent of its value in the last two weeks, and $9 billion in bitcoin was wiped out yesterday alone. This is Messari’s bloodbath-themed market chart from Wednesday morning:

It’s bad enough that even Crypto Twitter seems to be tugging at its collar, in turns panicking, scolding, and reassuring. To help you get a grip on this situation, here’s a breakdown of the three prominent theories behind what’s driving the market correction:

Theory 1: It’s Buy on the Rumor, Sell on the News

Crypto watchers had long awaited news on SEC approval of a new bitcoin exchange-traded fund, which would have been the first of its kind and allowed people to invest in cryptocurrencies without buying actual bitcoins. By removing barriers like the hassles of figuring out how to store cryptocurrency or convert it into fiat when you want to use it, huge new markets are potentially created. But Tuesday, the SEC delayed its decision until September, and that ugly chart up there is the result.

From Business Insider:

“Analysts at the London Block Exchange said in an email on Wednesday that the latest slump appears to have been triggered by a U.S. Securities and Exchange Commission’s announcement late on Tuesday. The regulator announced it is postponing a decision on whether to approve or deny a bitcoin ETF product from CBOE until September.

The market has been waiting for a long time for a regulated ETF product to hit the market as traders believe it will bring new money into the market. The postponement appears to have put off many bulls who had bet on an authorization this week from the SEC.”

Theory 2: It’s Just a Correction

Bitcoin trader and market commentator Josh Olszewicz offered his smackdown-slash-hot-take in chart form (not exactly sure, though, what chart we’re looking at here):

Meanwhile, Vinay Gupta, who managed the launch of Ethereum and rarely comments on cryptocurrency price fluctuations, saw fit to re-up a Medium post he wrote in May 2017 when ether, trading today in the mid-$300s, hit $100, valuing the market cap of Ethereum at $10 billion:

Gupta’s original commentary served as a justification for the rich valuation, walking readers through his ultimate, utopian vision for Ethereum and how smart contracts would take over every facet of business, law, and banking in coming decades, essentially suggesting that hitting $100 was just the beginning (a few weeks later, the price would soar over $300):

“It may well be used by ordinary people 50 times a day without ever realizing they have touched it. The coffee is hot and waiting for you when you arrive in the coffee shop, your lunch has a picture of the person who caught the tuna with a fishing line printed on the side, the solar panels are gleaming in the sun, and the computers are matching the supply to demand at the right price. That’s the vision of the smart contract world: stuff just works, because the computers just work. And that’s what we are building now.”

His tweet suggests he still feels the same, and that the recent price drop is nothing to worry about.

(Side note: why are fish the subject of oh so many social-good blockchain projects?)

Theory 3: It’s Hair on Fire Time

Theory 1 and theory 2 may both be true, but none of that matters if you took out a second mortgage on your house to go big on bitcoin when it was trading at almost $20,000 late last year.

This is the point where you may question whether cryptocurrency is nothing more than a pyramid scheme, whether blockchain is just the latest business buzzword that will be all but forgotten by 2020, that not enough people care where their tuna comes from, that barely anyone is actually using dapps.

If the value of cryptocurrencies is inherently based on nothing more than a collective fever dream, what happens when that dream starts to die? Then this selloff starts to look like something different: perhaps, the beginning of a rush for the exits.

Or, maybe it all depends on how far back you set the timeline when you pull your charts.